by Dave and Donald Moenning

After making new highs in five of the last six sessions, many analysts believe that it is time for the bulls to take a break. After all, the S&P 500 has (a) finished green for thirteen of the last sixteen days, (b) moved to new all-time highs, and (c) gained 8.3% in the process. Let’s face it folks; that’s a pretty decent run.

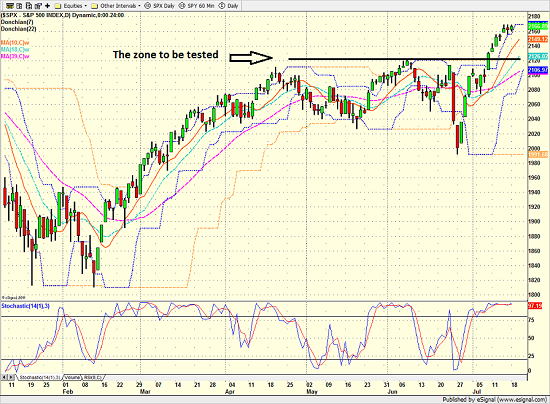

These analysts are not your perma-bear types calling for stocks to crash and burn, but rather the objective sorts who see an overbought condition in the major indices, a lack of momentum/enthusiasm during the last 3-4 days, and some rather punk earnings out of names like Netflix and IBM. As such, there are those who opine that now is as good a time as any for a test of the breakout zone, which would, at the same time, test the conviction of the bull camp.

So, from strictly a near-term perspective, we shouldn’t be too terribly surprised if the action gets sloppy for a while here and the bears attempt to make a run at 2120.

S&P 500 – Daily

View Larger Image

In fact, technicians suggest that a successful test of the breakout area at 2120 would actually reinvigorate the bull camp and be a prelude to the next leg higher. A leg that would cause many of the remaining bears to scramble for cover and be a reason for fresh cash to come into this market. Remember, nothing is more bullish than a market making new highs.

A Few Reasons to Be Optimistic

Although the list of worries about stocks remains as long as your arm, there are actually a few pretty good reasons to be optimistic about the outlook for the market. And I continue to believe that the true contrarian stance in the market at this time is to expect solid returns in the coming months – because almost nobody does!

In addition to the basic bullish themes such as (a) the ongoing chase for yield (remember, those high dividend stocks yield far more than lending money to governments for 10-20 years), (b) the expectations that both economic growth rates and corporate earnings have troughed and are poised to improve in the coming quarters, (c) the “lower for longer” theme (I.E. the idea that the Fed is going to stay “friendly” to stocks for longer than most expect), and (d) the fact that stocks finally broke out of a very long trading range, there are actually some other reasons to be optimistic on stocks going forward.

In addition to the fact that most folks on Wall Street remain unimpressed and aren’t expecting much from stocks in the good ‘ol USofA, there is the fact that we’ve seen breadth thrusts on a global basis as well as here at home, the fact that history is on the bulls’ side, and the fact that valuations outside the U.S. are not stretched at all by comparison. And since the best bull runs are global in nature, the idea that stocks are not overvalued when viewed from a global perspective is a positive.

Since time is running short this morning, I’ll leave the details on some of these bullish themes for tomorrow’s missive.

Turning to this morning… Earnings from Netflix, IBM and Goldman Sachs are dominating the news this morning and appear to be causing traders to hit the pause button. However, we’ve also got stronger than expect housing start and permit numbers to consider as well as the political circus taking place in Cleveland. But the weight of the evidence from a very short-term perspective seems to favor taking a break from the buy button at this time. Thus, we will need to keep an eye on the anticipated pullback and that 2120 level. But from my seat, I would expect to see the action get a bit sloppy as opposed to a full-fledged rout. But we shall see. Have a great day!

Current Market Drivers

We strive to identify the driving forces behind the market action on a daily basis. The thinking is that if we can both identify and understand why stocks are doing what they are doing on a short-term basis; we are not likely to be surprised/blind-sided by a big move. Listed below are what we believe to be the driving forces of the current market (Listed in order of importance).

1. The State of Global Central Bank Policies

2. The State of the Earnings Season

3. The State of U.S. Economic Growth

4. The State of the Stock Market Valuations

Thought For The Day:

“The degree of unprofitable anxiety in an investor’s life corresponds directly to the amount of time one spends on how markets should be acting rather than the way an investment IS action.” –Ned Davis

Here’s wishing you green screens and all the best for a great day,

David D. Moenning

Founder: Heritage Capital Research

Chief Investment Officer: Sowell Management Services

Looking for More on the State of the Markets?

Disclosures

The opinions and forecasts expressed herein are those of Mr. David Moenning and may not actually come to pass. Mr. Moenning’s opinions and viewpoints regarding the future of the markets should not be construed as recommendations. The analysis and information in this report is for informational purposes only. No part of the material presented in this report is intended as an investment recommendation or investment advice. Neither the information nor any opinion expressed constitutes a solicitation to purchase or sell securities or any investment program.

Any investment decisions must in all cases be made by the reader or by his or her investment adviser. Do NOT ever purchase any security without doing sufficient research. There is no guarantee that the investment objectives outlined will actually come to pass. All opinions expressed herein are subject to change without notice. Neither the editor, employees, nor any of their affiliates shall have any liability for any loss sustained by anyone who has relied on the information provided.

The analysis provided is based on both technical and fundamental research and is provided “as is” without warranty of any kind, either expressed or implied. Although the information contained is derived from sources which are believed to be reliable, they cannot be guaranteed.

David D. Moenning is an investment adviser representative of Sowell Management Services, a registered investment advisor. For a complete description of investment risks, fees and services, review the firm brochure (ADV Part 2) which is available by contacting Sowell. Sowell is not registered as a broker-dealer.

Employees and affiliates of Sowell may at times have positions in the securities referred to and may make purchases or sales of these securities while publications are in circulation. Positions may change at any time.

Investments in equities carry an inherent element of risk including the potential for significant loss of principal. Past performance is not an indication of future results.

Advisory services are offered through Sowell Management Services.