NAAIM Speaks is bi-monthly newsletter containing market insights and analysis from NAAIM member firms. “Speaks” is designed to provide a plethora of market analysis, indicators, some occasional humor, as well as a summary of NAAIM’s proprietary Dynamic Asset Allocation Model and Managers Exposure Index. The report is for informational uses only and is not to be construed as investment advice.

Does Your Investment Strategy Have What it Takes to Win The NAAIM “Shark Tank” Active Investing Strategy Competition?

What: NAAIM’s Active Investing Strategy Competition

When: Finals Competition – Sunday, May 3

Where: Tampa, Florida

Preliminary Competition Round: Begins in March

How To Apply: SIGN UP ONLINE

The Uncommon Knowledge 2020 NAAIM Active Investing Strategy Competition is open to all investing and trading practitioners who have developed an investment strategy with a live, verifiable, real money track record.

2020 Grand Prize

*** Live Distribution and Promotion on TAMP Offering ***

This Is The Dip You’ve Been Waiting For

By: David Moenning, Heritage Capital Research

Published: 2.3.20

The excuse du jour for the current pullback/correction/sloppy period is clearly the Coronavirus. But in reality, it could have been anything. As I’ve been saying, stocks had become overbought and investors over believed in the bullish, theme. You know, the idea that we were revisiting 2013 and 2017’s one-way market, where the only decision one had to make was what to buy next.

As is usually the case in these types of markets, something then came out of the woodwork to stir things up a bit and create some fear. Traders then all moved to a risk-off position at the same time and on Friday feared what the weekend headlines might bring. As a result, stocks whooshed lower.

I think it is important to remember that there is no such thing as a “healthy” correction while it is occurring. No, pullbacks seem to always get ugly and scare the bejeebers out of you.

Not A Full-Fledged Correction

By: Paul Schatz, Heritage Capital LLC

Published: 2.3.20

On the surface Friday looked like one of the those “puke” days when anything and everything go down. It was an ugly day, but I didn’t see evidence of investors in full panic mode nor selling at any price just to get out and relieve the pain. Friday looked like the makings of an internal or momentum low where selling and would be at its worst for this decline. Of course, one day later, it’s only a guess until there is more to view.

Looking at sector behavior, I see a number of sectors which are behaving better than the stock market and they are not just the defensive ones, REITs, staples and utilities. Software, internet, financials and discretionary are all hanging in, something you would not see if this decline was just getting going and accelerating to the downside. So…

Coronavirus: Cause for Analysis or Paralysis?

By: Jeffrey Miller Dash of Insight

Published: 2.2.20

As always, a new worry generates a new bundle of experts to help us. A close look often shows that these are old experts who now claim knowledge of a new field! Many of them have strong opinions about your investments. I spent most of the week learning from some experts who were new to me. I then pieced together a series of points that covers the key questions. As you will see, it is not specific advice, but it should be a good guide to your own analysis.

Determining the Facts: The source of the coronavirus and transmission from animals. This is a great interview with EcoHealth Alliance President Peter Daszak. Researchers are working on the source, whether it is evolving and the size of the ultimate threat. (The Scientist). An example – just one – of the detailed work being done. (New England Journal of Medicine).

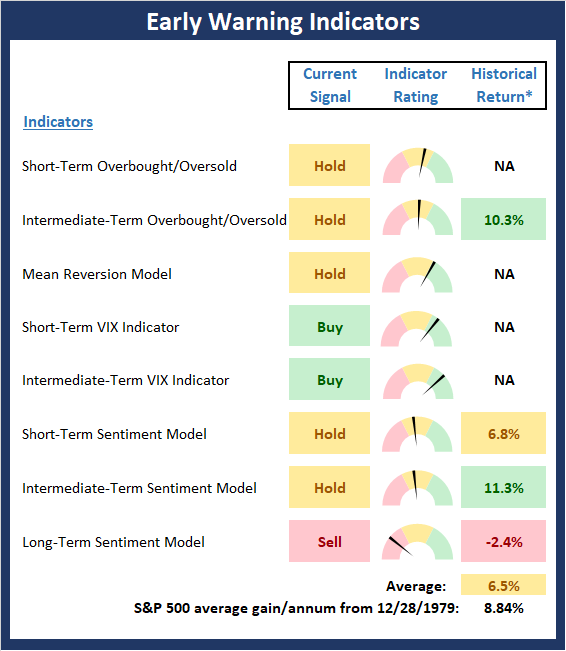

The Message From the NAAIM Indicator Wall: Time To Go The Other Way?

By: National Association of Active Investment Managers

Updated: 2.3.20

The NAAIM Indicator Wall provides a weekly update to a robust array of stock market indicators. The “wall” includes readings and explanations of indicators and/or models in the areas of price/trend, momentum, key price levels, overbought/sold readings, sentiment, monetary, economic, inflation, and market cycles.

This time, we’re featuring the Early Warning Board, which is designed to suggest when the table is set for the trend to “go the other way.”

Note: The Indicator Wall is a benefit provided to NAAIM Members and is password protected. To obtain a temporary password, contact NAAIM at 888-261-0787.

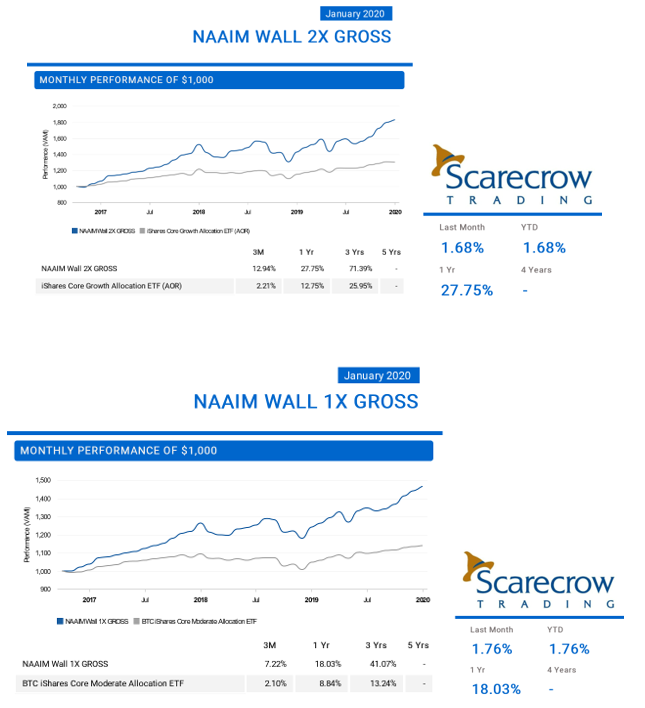

Mining the NAAIM Indicator Wall for Real World Applications

Len Fox at Scarecrow Trading, who is a two-time winner of the NAAIM Shark Tank Active Investing Strategy Competition developed a couple of portfolio strategies based on the NAAIM Indicator Wall. Below is an update of the two portfolios Scarecrow runs:

Feel free to contact Len or his team about the methodology used in these portfolios at (952) 250-7453.

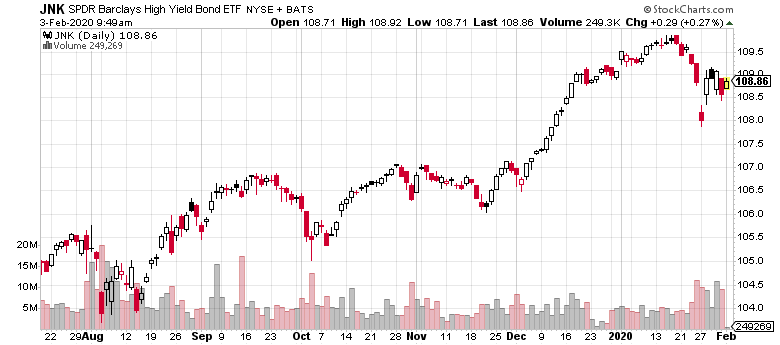

No Sign of Panic

By: Rob Bernstein, RGB Capital Group

Published: 2.3.20

Corrections are a normal part of investing and should be expected. The decline in stocks over the last two weeks doesn’t show any signs of panic selling. While I have no way to predict the future, this appears to be a normal, short-term correction at this point. For example, although risk is elevated, junk bonds have held up relatively well. The Merrill Lynch High-Yield Master II Index remains above its 50-day moving average and is down less than 0.7% since its January peak. This suggests that junk bond investors are not overly concerned with the overall economic outlook. I will continue to monitor the market and our investment strategies and make adjustments if necessary, to control overall risk in line with our strategy objectives….

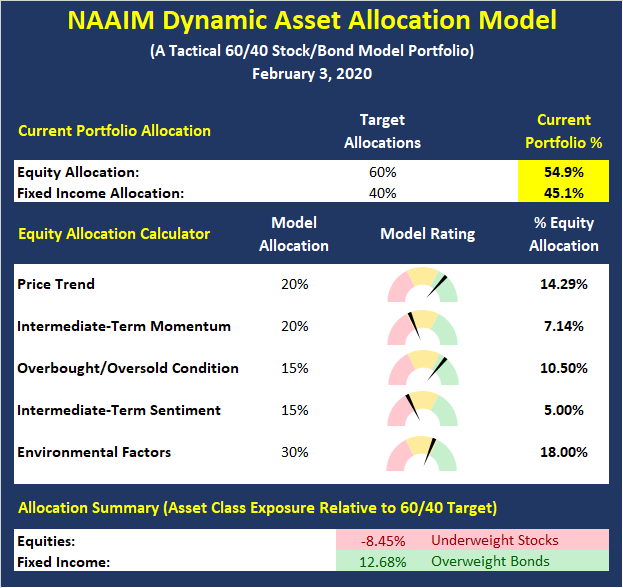

The NAAIM Dynamic Allocation Model

Designed to be a value-add benefit to membership, NAAIM offers a Dynamic Asset Allocation Model based on the NAAIM Indicator Wall of indicators and models. The overall objective of the model portfolio is to dynamically adapt to changing market environments and to keep equity exposure in line with conditions. The model targets a normalized allocation of 60% stocks and 40% Bonds.

Here is this week’s model allocation:

The model has been run live on the NAAIM website for several years and has demonstrated the ability to reduce exposure to market risk during negative environments such as those seen in 2015-16 and 2018.

More on the Dynamic Allocation Model and Historical Readings

The NAAIM Dynamic Allocation Model is for illustrative and informational purposes only, and does not in any way represent an endorsement by NAAIM or an investment recommendation.

More Positives Than Negatives

By: Sam and Bo Bills Bills Asset Management

Published: 1.31.20

As we stated last week, the Coronavirus outbreak has mostly been an excuse for investors to take some profits. We suspect the impact on the US economy will be minimal but it certainly bears watching. The impeachment trial looks to be wrapping up in the Senate with a likely acquittal of President Trump. Regardless of where you might stand politically, the ending of the current impeachment will be a positive for the market as it would be one less

uncertainty for the market to worry about. There have been a number of stellar earnings reports this week as the likes of Amazon and Apple both reported blow out reports. Despite the gains by these two (and other) market stalwarts, the markets have drifted down. Had earnings been a disappointment, the selling would have been much more pronounced…

Head Fake

By: Craig Thompson, President Asset Solutions

Published: 2.3.20

In last month’s newsletter, I highlighted two main points. One, the market was in an uptrend; however, overbought and due for some type of pullback/correction. Two, commodities and treasury yields were starting to breakout. Economically sensitive commodities such as copper and oil can be viewed as a proxy for the global economy. Seeing them start to rise after falling for an extended period was bullish for the economy/stock market. An upturn in both bond yields and commodities would be a strong signal of renewed global growth. These bullish market developments didn’t last long, however. Both commodities and bond yields broke-down last month proving those advances to be simply head fakes…

Alternative Currencies?

By: Dexter P. Lyons Issachar Fund

Published: 2.3.20

I believe these five companies have received a large amount of the liquidity (free money) the Fed has created as this money must find a home. These five companies are in all the major indexes so accumulating positions in these big-stock names may be a fast and easy way to put large sums of money to work, i.e. “alternative currencies”. Massive buying in these stocks has historically tended to create the slow and steady up trends we have been seeing in the major indexes since September, but that could be coming to an end. The concern I have is four of these five “alternative currencies” have been seeing massive amounts of high-volume distribution selling in recent days and that is one more reason to raise the caution flag…

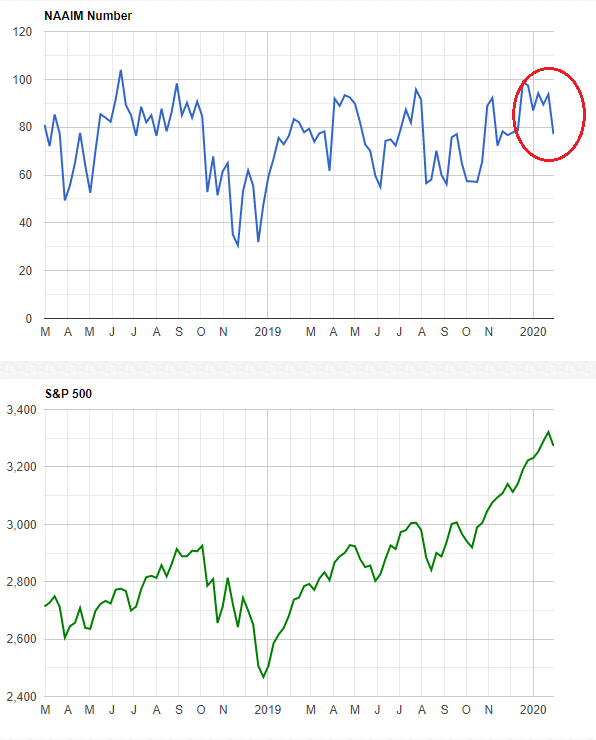

The NAAIM Member Exposure Index: Some Caution Creeping In

The NAAIM Exposure Index represents the average exposure to US Equity markets as reported by our members in the organization’s weekly survey. Note that many NAAIM members are risk managers and tend to reduce exposure to the markets during high risk environments.

The last week’s exposure reading is 77.

More on the NAAIM Exposure Index

NOT INVESTMENT ADVICE. The analysis and information in this report and on our website is for informational purposes only. No part of the material presented in this report or on our websites is intended as an investment recommendation or investment advice. Neither the information nor any opinion expressed nor any Portfolio constitutes a solicitation to purchase or sell securities or any investment program. The opinions and forecasts expressed are those of the editors and may not actually come to pass. The opinions and viewpoints regarding the future of the markets should not be construed as recommendations of any specific security nor specific investment advice. Investors should always consult an investment professional before making any investment.

Tags: NAAIM, NAAIM Speaks, Stocks market analysis, Stock Market Analysis, Stock market, stock market indicators, David Moenning, Paul Schatz, Jeffrey Miller, Rob Bernstein, Sam Bills, Bo Bills, Dexter Lyons, NAAIM Exposure Index, NAAIM Dynamic Allocation Model, Len Fox