NAAIM Speaks is monthly newsletter containing market insights and analysis from NAAIM member firms. “Speaks” is designed to provide a plethora of market analysis, indicators, some occasional humor, as well as a summary of NAAIM’s proprietary Dynamic Asset Allocation Model and Managers Exposure Index. The report is for informational uses only and is not to be construed as investment advice.

There Is Good News If You Look Hard Enough

By: David Moenning, Heritage Capital Research

Published: 4.6.20

The headlines have been awful. The human toll from the virus continues to mount. The economic impact is jaw dropping. And we’re told things are going to get worse this week.

Although stocks are bouncing in the early going Monday on the hope that the worst will soon be behind us, it is clear that stocks are in a bear market and that meaningful relief (I.E. Rallies that last more than a few days) can only come from good news on the virus front. Yes, the response by the Federal Reserve has been impressive. It’s true that the CARES Act will provide relief to families and small businesses. And to be sure, a deal between the Saudis and Russians would be a near-term positive. But the bottom line is the longer the virus sticks around, the more damage is done. However, there IS some good news out there…

Bulls Open Week With a Bang

By: Paul Schatz, Heritage Capital LLC

Published: 4.6.20

Without jinxing anything, the weekend seemed on the “quieter” side regarding the news. While it remains bad, things didn’t accelerate to the downside so that’s something. After an abysmal jobs report on Friday, stocks were not down all that much after finishing with a flurry. As I always say, it’s not what the news actually is, but rather how stocks react. A 30%+ decline prices in a lot of the bad news we are seeing and what’s in store down the road.

Futures are soaring in the pre-market. That’s likely to hold into the open and my sense is that it will be a big up day. Lots of people will feel relief. I may have to un-mute the TV and see if we hear talk of “THE” bottom being in and no more selling…

Navigating The Model Maze

By: Jeffrey Miller Dash of Insight

Published: 3.1.20

Once again, no one cares about the economic calendar. There are a few items with recent data – jobless claims, mortgage applications, and Michigan sentiment – but most reports are old news. Everyone is focused on the increase in coronavirus cases and deaths. There are plenty of predictions, each based on model from a reputable source. The variation is wide.

The question that needs an answer: How can we navigate the maze of models?

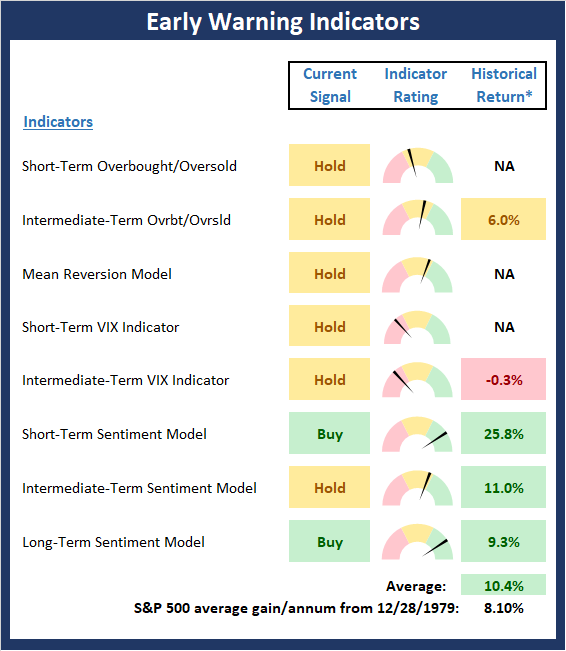

The Message From the NAAIM Indicator Wall: Early Warnings

By: National Association of Active Investment Managers

Updated: 3.2.20

The NAAIM Indicator Wall provides a weekly update to a robust array of stock market indicators. The “wall” includes readings and explanations of indicators and/or models in the areas of price/trend, momentum, key price levels, overbought/sold readings, sentiment, monetary, economic, inflation, and market cycles.

This time, we’re featuring the Early Warning Board, which is designed to suggest when the table is set for the trend to “go the other way.” This board did a very nice job of alerting us to when a “sigh of relief rally” would begin.

Note: The Indicator Wall is a benefit provided to NAAIM Members and is password protected. To obtain a temporary password, contact NAAIM at 888-261-0787.

Nothing to Fear But…

By: Ryan C. Redfern ShadowRidge Asset Management

Published: 3.30.20

Market jitters in February turned into all-out panic in March, the likes of which we rarely see. The S&P 5001 had a draw-down of -33.7% from February 19th to March 23rd before finally starting a rebound on Monday this week (Source: FastTrack).

It’s hard to say how long this rebound will last at this point. Now we are seeing the spike in unemployment that we expected to be the last straw before recession. So are we officially at the beginning of a new recession? Only time will tell. For now our plan is to try to make the most of this updraft while being ready to get back to protection mode quickly when our data dictates.

Rare Opportunity On Horizon

By: Rob Bernstein, RGB Capital Group

Published: 3.30.20

While it is clear that the market environment has improved over the last week, it is less clear if the recent low will be the low for this crisis. I believe that we should expect a continuation of the elevated volatility until the impacts of the coronavirus and the intentional shut down of a big portion of the global economy are clearer. Once a definitive bottom is in place, there will be a rare opportunity for low volatility gains.

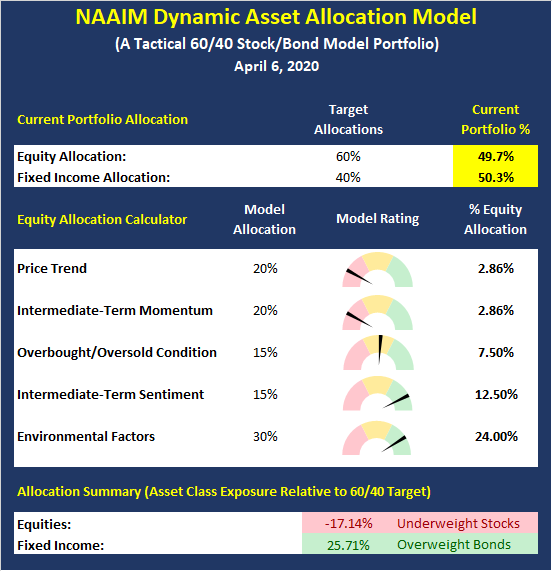

The NAAIM Dynamic Allocation Model

Designed to be a value-add benefit to membership, NAAIM offers a Dynamic Asset Allocation Model based on the NAAIM Indicator Wall of indicators and models. The overall objective of the model portfolio is to dynamically adapt to changing market environments and to keep equity exposure in line with conditions. The model targets a normalized allocation of 60% stocks and 40% Bonds.

Here is this week’s model allocation:

The model has been run live on the NAAIM website for several years and has demonstrated the ability to reduce exposure to market risk during negative environments such as those seen in 2015-16 and 2018.

More on the Dynamic Allocation Model and Historical Readings

The NAAIM Dynamic Allocation Model is for illustrative and informational purposes only, and does not in any way represent an endorsement by NAAIM or an investment recommendation.

Initial Targets and Longer-Term Thoughts

By: Sam and Bo Bills Bills Asset Management

Published: 4.3.20

The stock market is forward looking and some bad news is already priced in. The question becomes whether the news continues to be worse than expected. We hope that it won’t be, but expect that it could easily be much worse. Remember hope is not an investment strategy. Investors would be wise to continue using rallies to pare the market risk in their portfolios to their level of comfort. As we mentioned over the last couple of weeks, it would be highly unusual for the markets to snap back (V Bottom). Rather, it is much more likely for the market to revisit the lows (at best) and possibly take an even deeper dive.

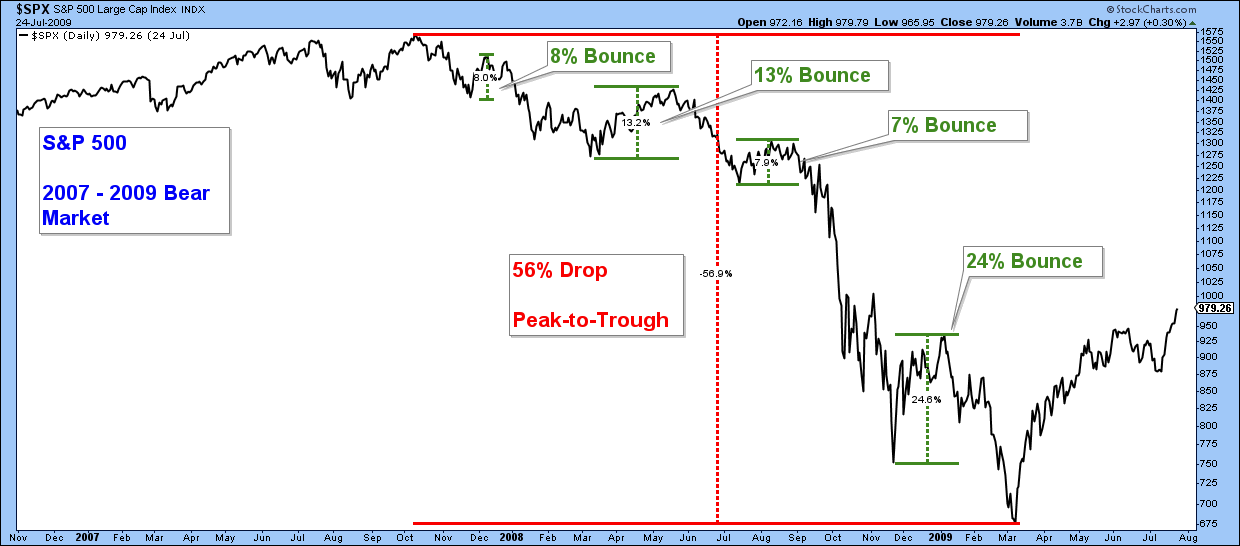

Will The Bear End With A Bang Or A Whimper?

By: Craig Thompson, President Asset Solutions

Published: 4.4.20

Bear markets don’t historically end after only four weeks. Dropping dramatically then advancing back to new all-time highs for a “V” shaped recovery. That is not to say that we should rule that scenario out. It is just that I believe that is a very low odds outcome based on what I am seeing in market technicals and how bear markets of the past have played out.

Below is a chart of the S&P 500 that shows the current bear market. We are less than 7 weeks into this bear market, which by historic standards, is the early innings of what could be a long, drawn-out process.

Curve Flattening?

By: Dexter P. Lyons Issachar Fund

Published: 4.6.20

I am practicing a little stock market social distancing waiting for a lower-risk entry which I feel could be soon. I believe cutting grass in the rain is not too wise, so I will wait for a better “sunny” day. One thing I have learned through the years is to protect my psychology, so I can live to invest another day. Avoiding “psychological damage” by letting small losses turn into huge losses then hoping (hope is not a strategy) to break even was a life lesson I never want to repeat. I prefer to sell when I “want to” and not when I “have to”. Everyone has a threshold of pain so drawing a “line in the sand” (maximum loss) has helped me stay out of trouble.

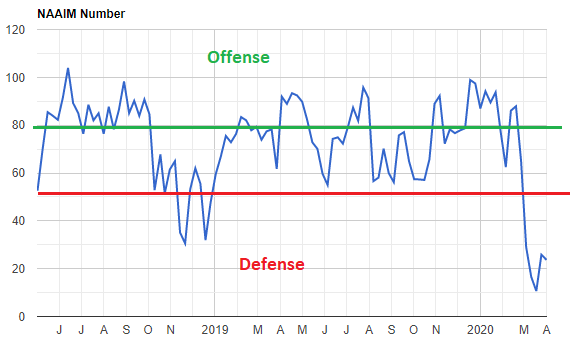

The NAAIM Member Exposure Index: Managers Got Defensive Quickly

The NAAIM Exposure Index represents the average exposure to US Equity markets as reported by our members in the organization’s weekly survey. Note that many NAAIM members are risk managers and tend to reduce exposure to the markets during high risk environments.

The last week’s exposure reading was 23.67, which remains a defensive reading.

More on the NAAIM Exposure Index

NOT INVESTMENT ADVICE. The analysis and information in this report and on our website is for informational purposes only. No part of the material presented in this report or on our websites is intended as an investment recommendation or investment advice. Neither the information nor any opinion expressed nor any Portfolio constitutes a solicitation to purchase or sell securities or any investment program. The opinions and forecasts expressed are those of the editors and may not actually come to pass. The opinions and viewpoints regarding the future of the markets should not be construed as recommendations of any specific security nor specific investment advice. Investors should always consult an investment professional before making any investment.

Tags: NAAIM, NAAIM Speaks, Stocks market analysis, Stock Market Analysis, Stock market, stock market indicators, David Moenning, Paul Schatz, Jeffrey Miller, Rob Bernstein, Ryan Redfern, Sam Bills, Bo Bills, Dexter Lyons, Craig Thompson, NAAIM Exposure Index, NAAIM Dynamic Allocation Model