NAAIM Speaks is monthly newsletter containing market insights and analysis from NAAIM member firms. “Speaks” is designed to provide a plethora of market analysis, indicators, some occasional humor, as well as a summary of NAAIM’s proprietary Dynamic Asset Allocation Model and Managers Exposure Index. The report is for informational uses only and is not to be construed as investment advice.

Are You Looking For Distribution of Your Investing Strategy? — NAAIM’s Active Investing Strategy Competition is For You!

What: NAAIM’s Active Investing Strategy Competition

When: Finals Competition – Sunday, May 3

Where: Tampa, Florida

Preliminary Competition Round: Begins in March

How To Apply: SIGN UP ONLINE

The Uncommon Knowledge 2020 NAAIM Active Investing Strategy Competition is open to all investing and trading practitioners who have developed an investment strategy with a live, verifiable, real money track record.

2020 Grand Prize

*** Live Distribution and Promotion on TAMP Offering ***

The Panic Playbook: A Blueprint For Market Crises

By: David Moenning, Heritage Capital Research

Published: 3.2.20

For investors of all shapes and sizes, the question of the day appears to be, now what? After the 14% thrashing of the Dow Jones Industrial Average in just seven sessions, one can’t be blamed for feeling a little shell shocked. In short, these types of market panics can leave one disoriented and unsure about what to do next.

But after doing this job since 1987, I have learned that these types of crises tend to follow a similar pattern. As such, I’d like to share the “panic playbook” with you…

Why The Stock Market Bottomed on Feb 28 and What to Expect

By: Paul Schatz, Heritage Capital LLC

Published: 3.4.20

I recently spent a good deal of time publishing a piece entitled 9th Correction of the Bull Market – Dow 30,000 Coming in Q3. While I may be biased, I think I did a pretty good job of putting the correction into proper context against the 8 other corrections during this bull market. So far, Friday 2/28 certainly has all the makings of the internal or momentum low I usually discuss during corrections.

In short, I believe the stock market bottomed on Friday. Here are a few arguments in my case…

Should Investors Heed the Message of the Markets?

By: Jeffrey Miller Dash of Insight

Published: 3.1.20

Despite the important economic data to be released in the week ahead, news about the current economy will not be the theme. The speed of last week’s market decline has drawn attention from everyone, including those who are not regular followers of financial news. I expect the punditry to be asking: Should investors heed the message of the markets?

Pundits love this sort of question. They need not deal with any actual data. They can weave stories using anecdotes. And anyone can sound very smart by describing what just happened and telling you “the message.”

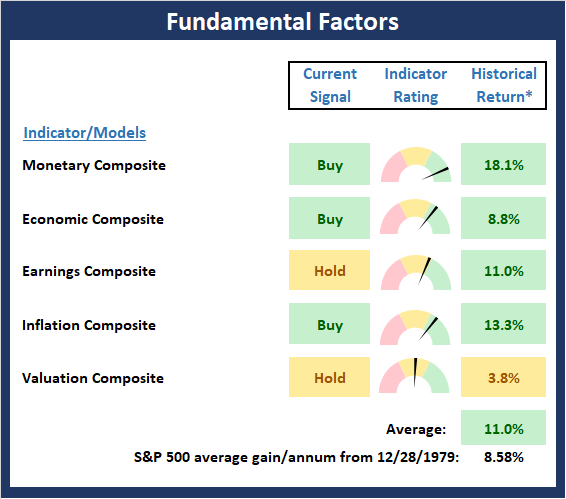

The Message From the NAAIM Indicator Wall: Fundamentals In Decent Shape

By: National Association of Active Investment Managers

Updated: 3.2.20

The NAAIM Indicator Wall provides a weekly update to a robust array of stock market indicators. The “wall” includes readings and explanations of indicators and/or models in the areas of price/trend, momentum, key price levels, overbought/sold readings, sentiment, monetary, economic, inflation, and market cycles.

This time, we’re featuring the Fundamental Board, which is designed to review the market’s fundamental factors in the areas of interest rates, the economy, inflation, and valuations.

Note: The Indicator Wall is a benefit provided to NAAIM Members and is password protected. To obtain a temporary password, contact NAAIM at 888-261-0787.

The Need To Remain Diligent

By: Rob Bernstein, RGB Capital Group

Published: 3.2.20

The ultimate impact of COVID-19 on the stock market is still unknown. It will depend on the ability of authorities around the globe to contain the spread of the virus. The selling, at least so far, appears to be orderly. While there are reasons to be concerned, I think there are also reasons to believe that the market could rebound and march to new highs. During times like this, it is important to remain diligent to your investment strategy and to avoid emotional decision making. I will continue to manage the RGB Capital Group strategies according to the parameters of the strategies and make adjustments when necessary.

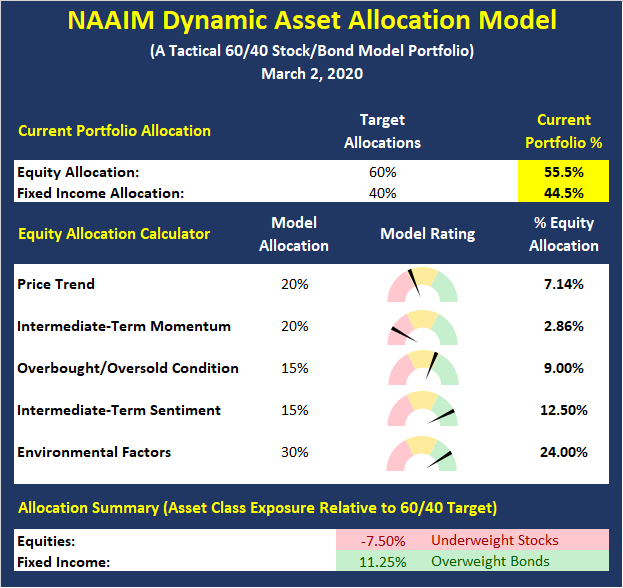

The NAAIM Dynamic Allocation Model

Designed to be a value-add benefit to membership, NAAIM offers a Dynamic Asset Allocation Model based on the NAAIM Indicator Wall of indicators and models. The overall objective of the model portfolio is to dynamically adapt to changing market environments and to keep equity exposure in line with conditions. The model targets a normalized allocation of 60% stocks and 40% Bonds.

Here is this week’s model allocation:

The model has been run live on the NAAIM website for several years and has demonstrated the ability to reduce exposure to market risk during negative environments such as those seen in 2015-16 and 2018.

More on the Dynamic Allocation Model and Historical Readings

The NAAIM Dynamic Allocation Model is for illustrative and informational purposes only, and does not in any way represent an endorsement by NAAIM or an investment recommendation.

Our Models Did Their Jobs

By: Ryan C. Redfern ShadowRidge Asset Management

Published: 2.28.20

So much for that good start we were off to this year. After weeks and weeks of ignoring the news of the coronavirus, apparently, a week ago someone decided it was time to sell. And sell they did!

Luckily for us, we started getting defensive as early as the 21st (see this month’s chart) and continued to sell to cash or bonds over the week. Anything we do continue to hold remains strong, from a relative strength perspective, against the stock market indexes.

Setting Up Like 2008? Or…

By: Sam and Bo Bills Bills Asset Management

Published: 2.28.20

Readers of this missive know that we have been calling for and expecting a correction of some sort to happen. In that respect, the magnitude of the decline (to this point) is not surprising. What is surprising is the veracity and violence of the decline. We never would have expected the full depth of a correction to take hold over the course of a week! It seems unprecedented but we faced similar declines in the throes of 2008…

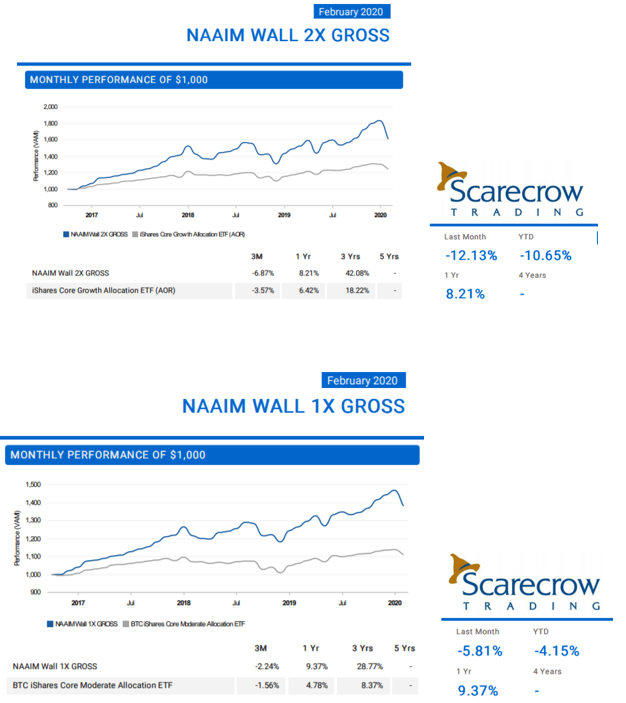

Mining the NAAIM Indicator Wall for Real World Applications

Len Fox at Scarecrow Trading, who is a two-time winner of the NAAIM Shark Tank Active Investing Strategy Competition developed a couple of portfolio strategies based on the NAAIM Indicator Wall. Below is an update of the two portfolios Scarecrow runs:

Feel free to contact Len or his team about the methodology used in these portfolios at (952) 250-7453.

The Long And Short Of It

By: Craig Thompson, President Asset Solutions

Published: 3.1.20

So where are we now? The answer, I believe, lies in what time period we are talking about. Short-term, my charts are suggesting we could be near a point where the stock market could bounce or at least stabilize. Long-term, however, the path of least resistance looks less optimistic. Let’s look at some charts that highlight this dichotomy…

Cash Is Not Trash!

By: Dexter P. Lyons Issachar Fund

Published: 3.2.20

As previously discussed, I heeded the “red flags’ and sold all positions, including our muni bond ETFs. The sky is not falling. However, risk appears elevated, and I believe risk management is now more important than ever so please be patient and do not try to catch a falling knife. My eyes are focused on tomorrow and how I want to be positioned for the next great opportunities that are developing.

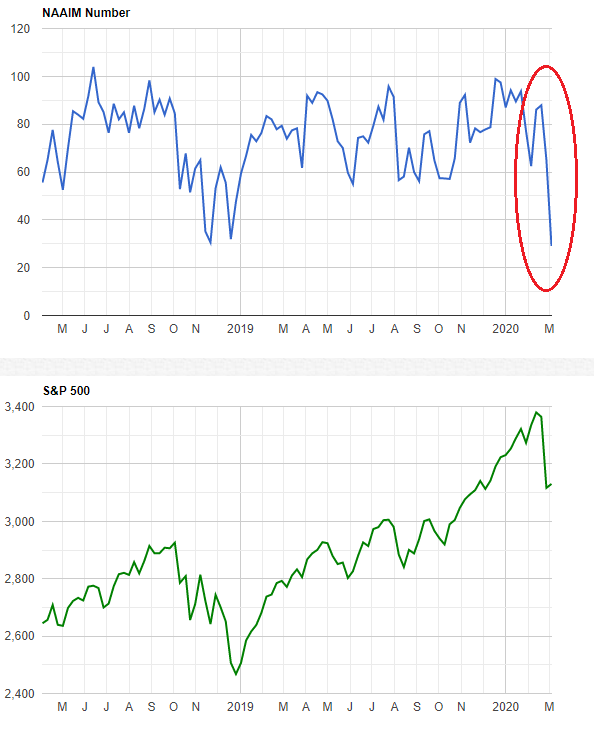

The NAAIM Member Exposure Index: Managers Got Defensive Quickly

The NAAIM Exposure Index represents the average exposure to US Equity markets as reported by our members in the organization’s weekly survey. Note that many NAAIM members are risk managers and tend to reduce exposure to the markets during high risk environments.

The last week’s exposure reading is 29.03 and was 65.03 on 2/26/20.

More on the NAAIM Exposure Index

NOT INVESTMENT ADVICE. The analysis and information in this report and on our website is for informational purposes only. No part of the material presented in this report or on our websites is intended as an investment recommendation or investment advice. Neither the information nor any opinion expressed nor any Portfolio constitutes a solicitation to purchase or sell securities or any investment program. The opinions and forecasts expressed are those of the editors and may not actually come to pass. The opinions and viewpoints regarding the future of the markets should not be construed as recommendations of any specific security nor specific investment advice. Investors should always consult an investment professional before making any investment.

Tags: NAAIM, NAAIM Speaks, Stocks market analysis, Stock Market Analysis, Stock market, stock market indicators, David Moenning, Paul Schatz, Jeffrey Miller, Rob Bernstein, Ryan Redfern, Sam Bills, Bo Bills, Dexter Lyons, Craig Thompson, NAAIM Exposure Index, NAAIM Dynamic Allocation Model, Len Fox