NAAIM Speaks is monthly newsletter containing market insights and analysis from NAAIM member firms. This newsletter is designed to provide a plethora of market analysis, indicators, some occasional humor, as well as a summary of NAAIM’s proprietary Dynamic Asset Allocation Model and Managers Exposure Index. The report is for informational uses only and is not to be construed as investment advice.

Time For A Rally?

By: David Moenning, Heritage Capital Research

Published: 10.2.23

Perhaps one of the most important qualities necessary to survive long-term in this business is an open mind. As I’ve lamented a time or two hundred over the years, too many investors are focused on making market predictions and/or about “being right.” Yet, as more than forty years of professional investing experience has taught me, this game is really all about “getting it right”…

Bulls Have The Edge

By: Paul Schatz, Heritage Capital LLC

Published: 10.2.23

Friday ended the week, month and quarter. And it was definitely a tale of two halves, much like Q1 with early strength and later weakness. And you already know that both time and have price have opened the window for a stock market bottom. If all goes according to plan, the low we see should create an opportunity for a rally into January and it could be significant…

Seasonality Strikes Again!

By: Ryan C. Redfern ShadowRidge Asset Management

Published: 9.29.23

It should be no surprise that September has been a weak month across most of the stock market, as historically it has the highest probability of any month to see losses. And this year is no different. However, what this does do is set up the market for a good rally into the end of the year…

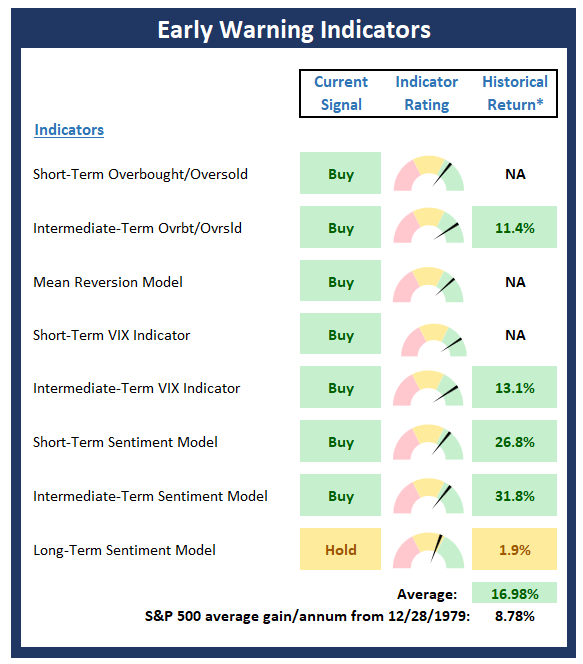

The Message From the NAAIM Indicator Wall

By: National Association of Active Investment Managers

The NAAIM Indicator Wall provides a weekly update to a robust array of stock market indicators. The “wall” includes readings and explanations of indicators and/or models in the areas of price/trend, momentum, key price levels, overbought/sold readings, sentiment, monetary, economic, inflation, and market cycles.

This time, we’re featuring the Early Warning Board , which is designed to suggest when the market may be ripe for a reversal on a short-term basis.

Note: The Indicator Wall is a benefit provided to NAAIM Members and is password protected. To obtain a temporary password, contact NAAIM at 888-261-0787.

A Weak Environment

By: Rob Bernstein, RGB Capital Group

Published: 10.2.23

The stock market environment is weak and being impacted by a number of factors including higher interest rates,

anticipated changes to monetary policy, and the overall health of the economy. The potential for a government shutdown

weighed on the markets last week. However, that crisis was averted with a last-minute deal over the weekend but the

positive news has not provided the market much support…

Big Move Coming!

By: Craig Thompson, President Asset Solutions

Published: 9.4.23

In our August 7, 2023 Market Update, Stock Market Weakness Likely, I mentioned the market was at the top of its uptrending channel and was likely to correct to the lower half of that channel. Here we are two months later and the S&P 500 is sitting on the trendline that defines the lower end of that channel. I believe we are about to see a strong move in one direction or the other. If it is down, watch out below…

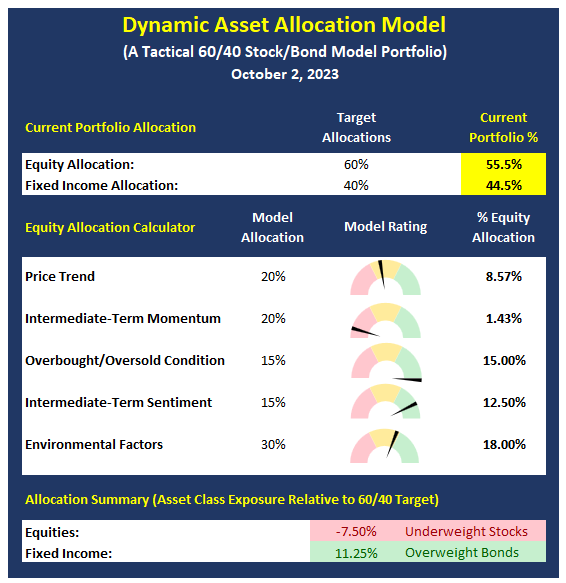

The NAAIM Dynamic Allocation Model

Designed to be a value-add benefit to membership, NAAIM offers a Dynamic Asset Allocation Model based on the NAAIM Indicator Wall of indicators and models. The overall objective of the model portfolio is to dynamically adapt to changing market environments and to keep equity exposure in line with conditions. The model targets a normalized allocation of 60% stocks and 40% Bonds.

Here is this week’s model allocation:

The model has been run live on the NAAIM website for several years and has demonstrated the ability to reduce exposure to market risk during negative environments such as those seen in 2015-16 and 2018.

More on the Dynamic Allocation Model and Historical Readings

The NAAIM Dynamic Allocation Model is for illustrative and informational purposes only, and does not in any way represent an endorsement by NAAIM or an investment recommendation.

Failure is Concerning

By: Sam and Bo Bills Bills Asset Management

Published: 9.29.23

With the market oversold, we expected some sort of rally this past week and we have gotten a small one. The failure of the market, to this point, to mount a more serious counter-trend rally is concerning. We’ll see if next week provides a little more strength. The S&P tested support at 4240 before bouncing back up to resistance today at the 4300 area. It is struggling to get above that level. Stay cautious. ..

Time To Manage Risk!

By: Dexter P. Lyons Issachar Fund

Published: 10.2.23

Interest rates and risk have risen, and more stocks were sold as our sell-stops were triggered. The market has not been rewarding stock investors, and junk bonds are trading well below their 50-day moving average, indicating a lack of investor appetite for risk. I believe there are times to be invested and there are times to sit patiently. I have learned that market corrections have always presented incredible opportunities after the sellers capitulate and buyers step up. The selling will likely continue until a significant event causes a market bottom, but we are not there yet…

The NAAIM Member Exposure Index

The NAAIM Exposure Index represents the average exposure to US Equity markets as reported by our members in the organization’s weekly survey. Note that many NAAIM members are risk managers and tend to reduce exposure to the markets during high risk environments.

Click To See the Current Exposure Index

NOT INVESTMENT ADVICE. The analysis and information in this report and on our website is for informational purposes only. No part of the material presented in this report or on our websites is intended as an investment recommendation or investment advice. Neither the information nor any opinion expressed nor any Portfolio constitutes a solicitation to purchase or sell securities or any investment program. The opinions and forecasts expressed are those of the editors and may not actually come to pass. The opinions and viewpoints regarding the future of the markets should not be construed as recommendations of any specific security nor specific investment advice. Investors should always consult an investment professional before making any investment.

Tags: NAAIM, NAAIM Speaks, Stocks market analysis, Stock Market Analysis, Stock market, stock market indicators, David Moenning, Heritage Capital Research, Paul Schatz, Heritage Capital LLC, Rob Bernstein, RGB Capital Group, Ryan Redfern, Shadowridge Asset Management, Sam Bills, Bo Bills, Bills Asset Management, Dexter Lyons, Issachar Fund, Jim Lee, Stratfi, Craig Thompson, Asset Solutions, NAAIM Exposure Index, NAAIM Dynamic Allocation Model