NAAIM Speaks is monthly newsletter containing market insights and analysis from NAAIM member firms. “Speaks” is designed to provide a plethora of market analysis, indicators, some occasional humor, as well as a summary of NAAIM’s proprietary Dynamic Asset Allocation Model and Managers Exposure Index. The report is for informational uses only and is not to be construed as investment advice.

What Could Go Wrong?

By: David Moenning, Heritage Capital Research

Published: 5.3.21

My friend/colleague Mr. Jeff Pietsch, CFA and I were asked last week to write an article speculating on the reasons why the U.S. stock market could experience a correction in the coming weeks/months ahead. It was a fun exercise and I thought it might be worth a read. So, without further ado, here are “eight reasons to expect a pullback – and one not to worry.”

Number One Question Asked Since the Pandemic

By: Paul Schatz, Heritage Capital LLC

Published: 5.4.21

Unfortunately, the COVID-19 pandemic caused many investors to alter their portfolios, often not to their long-term benefit. It’s certainly understandable to have wanted to do something in response to this unprecedented catastrophe. The problem is, as is often the case, that emotional responses often lead into unwise financial moves that must be corrected before they do permanent harm…

The New Pattern Continues

By: Ryan C. Redfern ShadowRidge Asset Management

Published: 4.30.21

Last month I mentioned how we noticed that the market has been peaking mid-month and then selling off into the end of the month. This happened in January, February, and March this year. While I didn’t intend that observation to also be a projection, it seems to have happened again in April, as the S&P 5001 did seem to peak on April 16th, only to trade sideways until the last days of the month. As of Thursday night, our Shadowridge Dashboard is showing Positive to Negative sectors as 11 to 0 (in other words, all positive) – which we haven’t seen in quite a while.

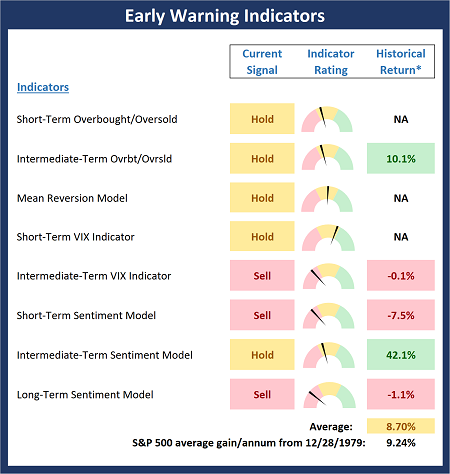

The Message From the NAAIM Indicator Wall

By: National Association of Active Investment Managers

Updated: 3.1.21

The NAAIM Indicator Wall provides a weekly update to a robust array of stock market indicators. The “wall” includes readings and explanations of indicators and/or models in the areas of price/trend, momentum, key price levels, overbought/sold readings, sentiment, monetary, economic, inflation, and market cycles.

This time, we’re featuring the Early Warning Board , which is designed to suggest when the table is set for the trend to “go the other way.”

Note: The Indicator Wall is a benefit provided to NAAIM Members and is password protected. To obtain a temporary password, contact NAAIM at 888-261-0787.

The Trend Is Your Friend

By: Rob Bernstein, RGB Capital Group

Published: 5.3.21

The S&P 500 Index started the month of April with strong gains

but trended sideways during the last two weeks. The index

ended the month in positive territory and remains in an

uptrend as can be seen by its uptrending 21-day (one month)

moving average.

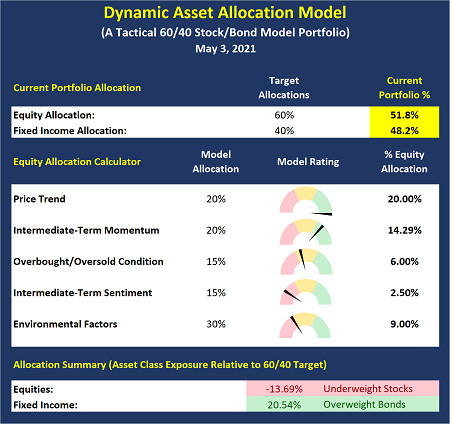

The NAAIM Dynamic Allocation Model

Designed to be a value-add benefit to membership, NAAIM offers a Dynamic Asset Allocation Model based on the NAAIM Indicator Wall of indicators and models. The overall objective of the model portfolio is to dynamically adapt to changing market environments and to keep equity exposure in line with conditions. The model targets a normalized allocation of 60% stocks and 40% Bonds.

Here is this week’s model allocation:

The model has been run live on the NAAIM website for several years and has demonstrated the ability to reduce exposure to market risk during negative environments such as those seen in 2015-16 and 2018.

More on the Dynamic Allocation Model and Historical Readings

The NAAIM Dynamic Allocation Model is for illustrative and informational purposes only, and does not in any way represent an endorsement by NAAIM or an investment recommendation.

Sell In May and Go Away?

By: Sam and Bo Bills Bills Asset Management

Published: 4.30.21

Where has the year gone? Today marks the end of April and 2021 is flying by. It has been an excellent year for the markets

thus far. As the calendar turns into May, you will begin hearing the “sell in May” crowd crowing loudly. While this indicator

holds some validity, it is by no means a reason to get out of the market and sell everything. There are plenty of years where

May and beyond proved to be an excellent source of market returns. That said, this may be a year to watch things more

closely…

Short Term Top?

By: Dexter P. Lyons Issachar Fund

Published: 5.3.21

I did a lot of selling last week before earnings announcements, and I have lots of cash to invest. However, the major indexes may have put in a short-term top, and it feels like the market is ready to roll over and correct a bit. I have a rule not to hold a stock through its earnings release because the risk of a gap down in price on an earnings miss is too great. I have a hard time finding growth stocks to buy that are not already extended in price, so I will exercise discipline and wait for a better opportunity…

The NAAIM Member Exposure Index: Active Managers Turning Cautious

The NAAIM Exposure Index represents the average exposure to US Equity markets as reported by our members in the organization’s weekly survey. Note that many NAAIM members are risk managers and tend to reduce exposure to the markets during high risk environments.

NOT INVESTMENT ADVICE. The analysis and information in this report and on our website is for informational purposes only. No part of the material presented in this report or on our websites is intended as an investment recommendation or investment advice. Neither the information nor any opinion expressed nor any Portfolio constitutes a solicitation to purchase or sell securities or any investment program. The opinions and forecasts expressed are those of the editors and may not actually come to pass. The opinions and viewpoints regarding the future of the markets should not be construed as recommendations of any specific security nor specific investment advice. Investors should always consult an investment professional before making any investment.

Tags: NAAIM, NAAIM Speaks, Stocks market analysis, Stock Market Analysis, Stock market, stock market indicators, David Moenning, Paul Schatz, Rob Bernstein, Ryan Redfern, Sam Bills, Bo Bills, Dexter Lyons, Craig Thompson, NAAIM Exposure Index, NAAIM Dynamic Allocation Model