NAAIM Speaks is monthly newsletter containing market insights and analysis from NAAIM member firms. “Speaks” is designed to provide a plethora of market analysis, indicators, some occasional humor, as well as a summary of NAAIM’s proprietary Dynamic Asset Allocation Model and Managers Exposure Index. The report is for informational uses only and is not to be construed as investment advice.

Is The Reddit Rebellion Here To Stay?

By: David Moenning, Heritage Capital Research

Published: 2.1.21

Source: Ned Davis Research Group

It appears that all anyone wants to talk about these days is “Gamestonk!” And frankly, I can’t blame them. When a stock soars more 16 times in a matter of 12 trading days, it certainly gets your attention!

Am I Wrong?

By: Paul Schatz, Heritage Capital LLC

Published: 2.4.21

Thankfully, the markets are calming down from the Gamestop Saga, but it is hard to believe that the whole thing is over. It may be over for the current stocks, but there should be others. And my experience says that the outcome will not be the same and the little guy will be hurt. I just do not believe that the hedge funds and big money will be fooled again. And neither will the platforms like Robinhood and Interactive Brokers….

Does the Reddit Rebellion Threaten Investor Portfolios?

By: Jeffrey Miller Dash of Insight

Published: 1.30.21

Just as investors were assessing the impacts of the pandemic, business closures, and a recession, a new source of worry appeared. Since it was unanticipated, should it be called a “black swan?” Whatever the label, investors are wondering: Is the Reddit Rebellion a threat to my investments?

The Message From the NAAIM Indicator Wall

By: National Association of Active Investment Managers

Updated: 2.1.21

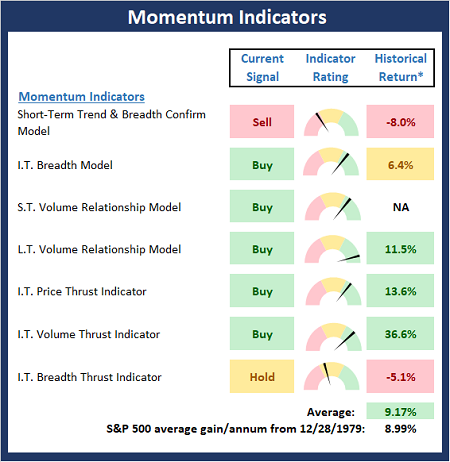

The NAAIM Indicator Wall provides a weekly update to a robust array of stock market indicators. The “wall” includes readings and explanations of indicators and/or models in the areas of price/trend, momentum, key price levels, overbought/sold readings, sentiment, monetary, economic, inflation, and market cycles.

This time, we’re featuring the Momentum Board , which is designed to identify if there is any “oomph” behind the market’s recent rally.

Note: The Indicator Wall is a benefit provided to NAAIM Members and is password protected. To obtain a temporary password, contact NAAIM at 888-261-0787.

Getting Close To a Top

By: Ryan C. Redfern ShadowRidge Asset Management

Published: 1.29.21

As we mentioned last month, the valuation of the stock market measured by the Shiller PE Ratio is still uncomfortably high. It’s far too early to be calling a top in the stock market, but I can’t help but think we’re getting close. Or at least will be pushing the boundaries over the next few months or quarters….

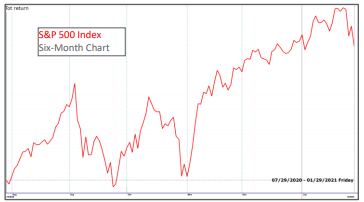

The Trend Is Still Your Friend

By: Rob Bernstein, RGB Capital Group

Published: 2.1.21

The stock market has been in a strong rally since November 1st, so a little profit taking over the last several trading days in the equity markets is not all that surprising. An uptrend is defined by a series of stronger up legs followed by weaker down legs and as long as that pattern remains, the market should be considered in an uptrend…

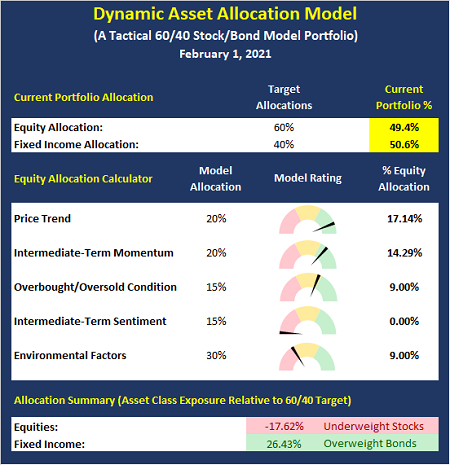

The NAAIM Dynamic Allocation Model

Designed to be a value-add benefit to membership, NAAIM offers a Dynamic Asset Allocation Model based on the NAAIM Indicator Wall of indicators and models. The overall objective of the model portfolio is to dynamically adapt to changing market environments and to keep equity exposure in line with conditions. The model targets a normalized allocation of 60% stocks and 40% Bonds.

Here is this week’s model allocation:

The model has been run live on the NAAIM website for several years and has demonstrated the ability to reduce exposure to market risk during negative environments such as those seen in 2015-16 and 2018.

More on the Dynamic Allocation Model and Historical Readings

The NAAIM Dynamic Allocation Model is for illustrative and informational purposes only, and does not in any way represent an endorsement by NAAIM or an investment recommendation.

Gaming The System

By: Sam and Bo Bills Bills Asset Management

Published: 1.29.21

The GameStop story is a fascinating case study on the workings of the market. When GME doubled in price back in

November it got the attention of “smart traders” and hedge funds on Wall Street. The “smart money” started shorting the

stock (betting the price would go down). The Reddit world responded by buying more GME forcing “smart traders” to cover

their shorts by buying shares to cover their shorts and driving up the price. The process has been repeated a number of

times and GME is now trading…

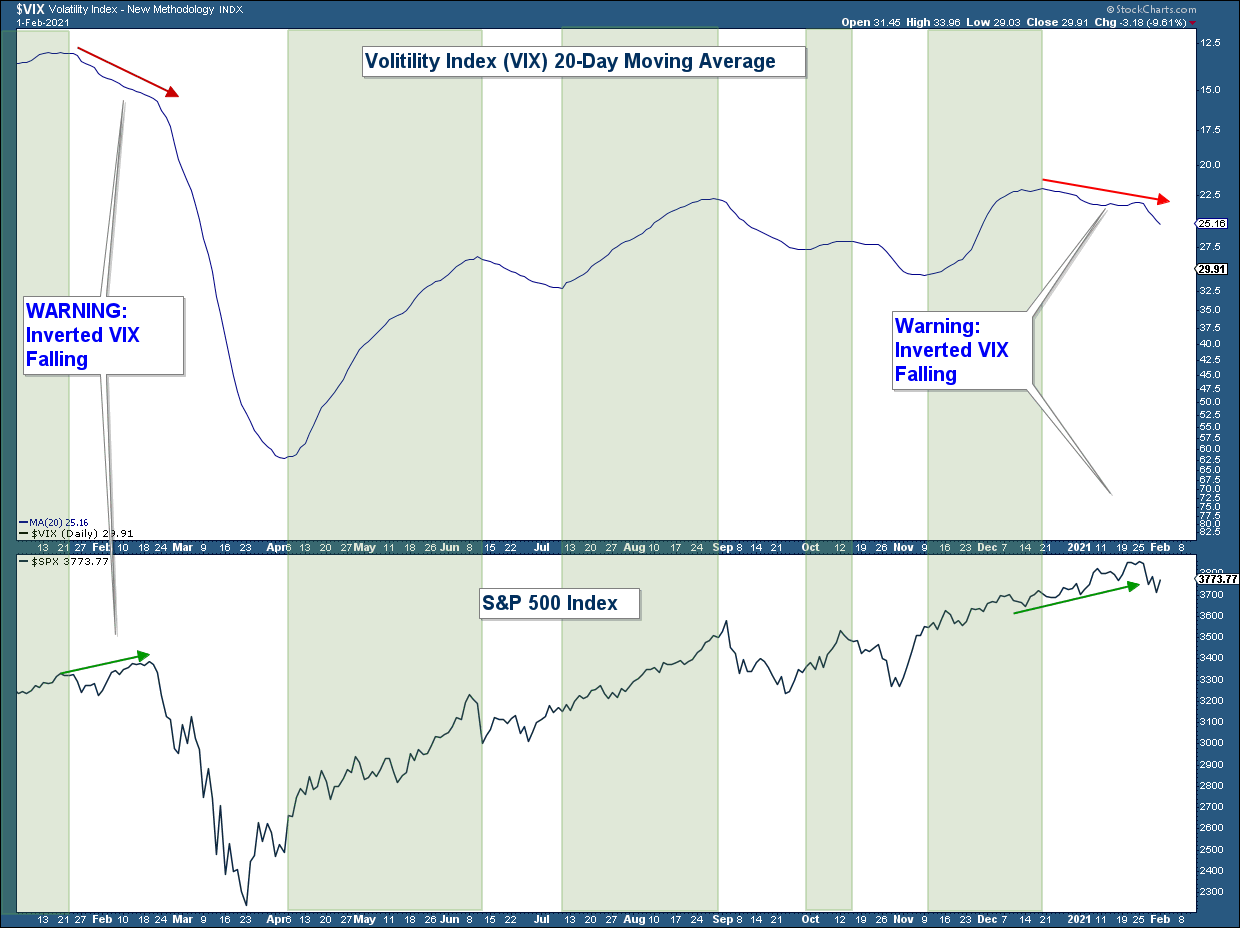

Risk is Rising

By: Craig Thompson, President Asset Solutions

Published: 2.1.21

Long-term the stock market is in an uptrend. However, market internals suggests that short-term risk is rising given the continued deterioration in market sentiment and breadth…

Risk-Reward Ratio is Falling

By: Dexter P. Lyons Issachar Fund

Published: 2.1.21

I believe the stock market risk level has risen to a point where the risk is slightly greater than the potential reward. If our remaining stocks fall out of favor, I will likely sell all positions and sit in cash until my perception of risk declines. My focus is on the indexes and leading growth stocks, and they are telling me that risk is rising…

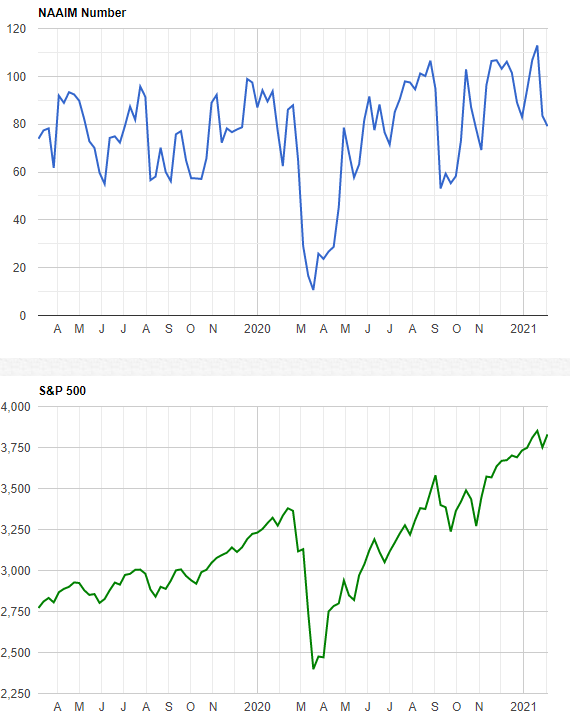

The NAAIM Member Exposure Index: Managers Took Some Chips Off The Table

The NAAIM Exposure Index represents the average exposure to US Equity markets as reported by our members in the organization’s weekly survey. Note that many NAAIM members are risk managers and tend to reduce exposure to the markets during high risk environments.

More on the NAAIM Exposure Index

NOT INVESTMENT ADVICE. The analysis and information in this report and on our website is for informational purposes only. No part of the material presented in this report or on our websites is intended as an investment recommendation or investment advice. Neither the information nor any opinion expressed nor any Portfolio constitutes a solicitation to purchase or sell securities or any investment program. The opinions and forecasts expressed are those of the editors and may not actually come to pass. The opinions and viewpoints regarding the future of the markets should not be construed as recommendations of any specific security nor specific investment advice. Investors should always consult an investment professional before making any investment.

Tags: NAAIM, NAAIM Speaks, Stocks market analysis, Stock Market Analysis, Stock market, stock market indicators, David Moenning, Paul Schatz, Jeffrey Miller, Rob Bernstein, Ryan Redfern, Sam Bills, Bo Bills, Dexter Lyons, Craig Thompson, NAAIM Exposure Index, NAAIM Dynamic Allocation Model