NAAIM Speaks is monthly newsletter containing market insights and analysis from NAAIM member firms. This newsletter is designed to provide a plethora of market analysis, indicators, some occasional humor, as well as a summary of NAAIM’s proprietary Dynamic Asset Allocation Model and Managers Exposure Index. The report is for informational uses only and is not to be construed as investment advice.

Greedy, Giddy & Euphoric

By: Paul Schatz, Heritage Capital LLC

Published: 11.15.21

The bulls enjoyed a nice bounce back on Friday from the minuscule pullback last week. While it’s not my highest conviction play it certainly looks like there should a bit more downside to come, and preferably before the holiday. As I mentioned last week, sentiment is getting to the point where is about as euphoric, greedy and giddy as it ever gets, rivaling several spots in the post-2008 bull market as well as the Dotcom era…

Reasons for the Rally…

By: David Moenning, Heritage Capital Research

Published: 11.08.21

That giant hissing sound you may hear at the corner of Broad and Wall these days is the air escaping the bear camp’s balloon. Cutting to the chase, the bulls now look to be in stampede mode and have been trampling their opponents on a daily basis…

Things Are Looking Good

By: Ryan C. Redfern ShadowRidge Asset Management

Published: 10.28.21

Last month we said we were hoping to see the market pick a direction and run – and that is what we got. And that strength has held through the end of the month. Hopefully it can maintain that momentum through November…

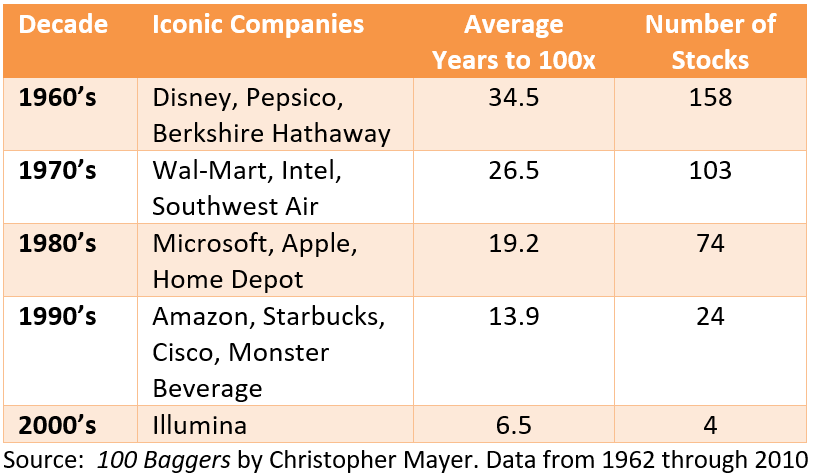

The World Really IS Moving Faster

By: James H. Lee StratFI

Published: 11.01.21

One of my favorite investment reads from the past year is 100 Baggers: Stocks that Return 100-to-1 and How to Find Them, by Christopher Mayer. I’d never seen this type of information collected in just one place. It’s worth digging into the appendix to “get the big picture.”

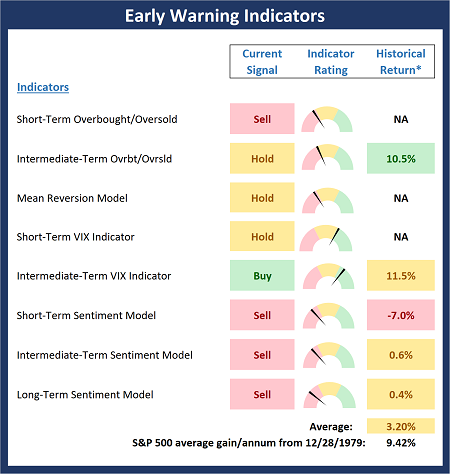

The Message From the NAAIM Indicator Wall

By: National Association of Active Investment Managers

Updated: 11.15.21

The NAAIM Indicator Wall provides a weekly update to a robust array of stock market indicators. The “wall” includes readings and explanations of indicators and/or models in the areas of price/trend, momentum, key price levels, overbought/sold readings, sentiment, monetary, economic, inflation, and market cycles.

This time, we’re featuring the Early Warning Indicator Board , which is designed to to suggest when the market may be ripe for a reversal on a short-term basis.

Note: The Indicator Wall is a benefit provided to NAAIM Members and is password protected. To obtain a temporary password, contact NAAIM at 888-261-0787.

A Breather is Needed

By: Rob Bernstein, RGB Capital Group

Published: 11.08.21

The stock market doesn’t tend to move up in a straight line but typically moves up in a series of strong up legs followed by weaker down legs. While the equity markets have moved almost straight up over the last three weeks, that won’t last forever, and it would not be surprising if the major stock market

indices took a little breather over the next week or so…

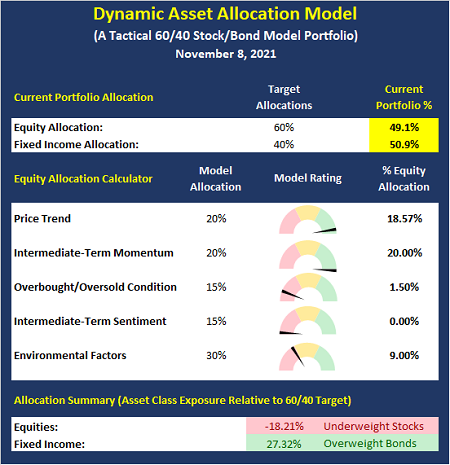

The NAAIM Dynamic Allocation Model

Designed to be a value-add benefit to membership, NAAIM offers a Dynamic Asset Allocation Model based on the NAAIM Indicator Wall of indicators and models. The overall objective of the model portfolio is to dynamically adapt to changing market environments and to keep equity exposure in line with conditions. The model targets a normalized allocation of 60% stocks and 40% Bonds.

Here is this week’s model allocation:

The model has been run live on the NAAIM website for several years and has demonstrated the ability to reduce exposure to market risk during negative environments such as those seen in 2015-16 and 2018.

More on the Dynamic Allocation Model and Historical Readings

The NAAIM Dynamic Allocation Model is for illustrative and informational purposes only, and does not in any way represent an endorsement by NAAIM or an investment recommendation.

TINA and FOMO, Oh My!

By: Sam and Bo Bills Bills Asset Management

Published: 11.12.21

There have been no shortage of acronyms to mark this market environment. TINA (There Is No Alternative) and FOMO (Fear Of Missing Out) are two of the most prominent ones. While not a big fan of trendy acronyms, there is no denying the reality of them. With interest rates as low as they have been for several years, bonds and other interest-bearing instruments cannot keep up with the cost of living. The rapid increase in inflation has only exacerbated the issue…

Still Going Strong

By: Dexter P. Lyons Issachar Fund

Published: 11.15.21

The inflationary news shocked the market on Wednesday; then, the market rebounded nicely on Thursday and Friday. This kind of action tells me that buyers were in control, and the uptrend has room to run. This is a historically good time of year to be invested, so we have “seasonality” forces working in our favor. If I had new money to invest, I am still finding stocks with great fundamentals and technical chart patterns…

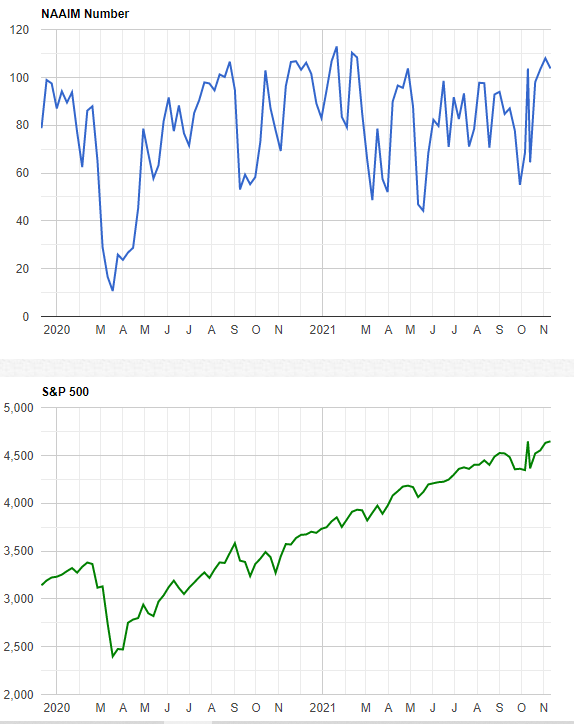

The NAAIM Member Exposure Index

The NAAIM Exposure Index represents the average exposure to US Equity markets as reported by our members in the organization’s weekly survey. Note that many NAAIM members are risk managers and tend to reduce exposure to the markets during high risk environments.

NOT INVESTMENT ADVICE. The analysis and information in this report and on our website is for informational purposes only. No part of the material presented in this report or on our websites is intended as an investment recommendation or investment advice. Neither the information nor any opinion expressed nor any Portfolio constitutes a solicitation to purchase or sell securities or any investment program. The opinions and forecasts expressed are those of the editors and may not actually come to pass. The opinions and viewpoints regarding the future of the markets should not be construed as recommendations of any specific security nor specific investment advice. Investors should always consult an investment professional before making any investment.

Tags: NAAIM, NAAIM Speaks, Stocks market analysis, Stock Market Analysis, Stock market, stock market indicators, David Moenning, Paul Schatz, Rob Bernstein, Ryan Redfern, Sam Bills, Bo Bills, Dexter Lyons, Craig Thompson, NAAIM Exposure Index, NAAIM Dynamic Allocation Model