NAAIM Speaks is monthly newsletter containing market insights and analysis from NAAIM member firms. “Speaks” is designed to provide a plethora of market analysis, indicators, some occasional humor, as well as a summary of NAAIM’s proprietary Dynamic Asset Allocation Model and Managers Exposure Index. The report is for informational uses only and is not to be construed as investment advice.

Good News Lends Bulls A Hand

By: David Moenning, Heritage Capital Research

Published: 8.6.20

With Coronavirus cases continuing to increase in many parts of the country, many may be wondering why stocks have been rallying. The bottom line is there has been some surprisingly good news on the economic front…

Warning Signs Abound, But…

By: Paul Schatz, Heritage Capital LLC

Published: 8.5.20

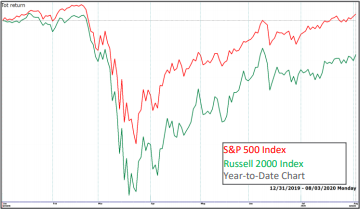

Full of cracks and warnings, the new bull market continues to chop higher. The S&P 500 has exceeded its June 8th high without much fanfare while the Dow Industrials, S&P 400 and Russell 2000 have still been unable to best their June highs. Of course, the NASDAQ 100 remains in a universe of its own although as we have discussed, it’s really just a handful of stocks. You know the ones…

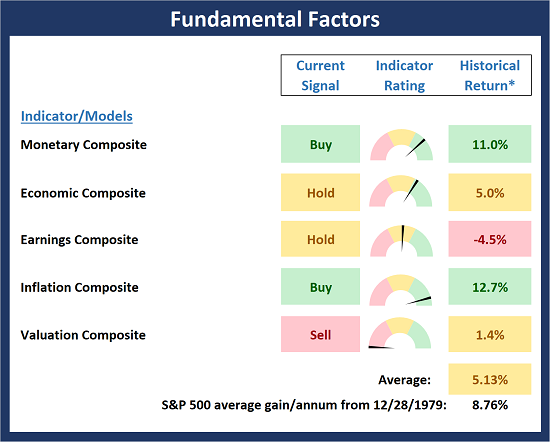

The Message From the NAAIM Indicator Wall: Fundamentals Remain Supportive

By: National Association of Active Investment Managers

Updated: 3.2.20

The NAAIM Indicator Wall provides a weekly update to a robust array of stock market indicators. The “wall” includes readings and explanations of indicators and/or models in the areas of price/trend, momentum, key price levels, overbought/sold readings, sentiment, monetary, economic, inflation, and market cycles.

This time, we’re featuring the Fundamental Factors Board , which is designed to identify the p overall “state” of the stock market’s fundamental backdrop.

Note: The Indicator Wall is a benefit provided to NAAIM Members and is password protected. To obtain a temporary password, contact NAAIM at 888-261-0787.

The Worst Six Months Of The Year?

By: Ryan C. Redfern ShadowRidge Asset Management

Published: 8.1.20

Historically, we’re in the “worst 6 months” of the year for stock market performance (Stock Trader’s Almanac), with September and October being two of the most challenging months for the market. I wouldn’t be surprised to see market volatility pick back up in that period, especially going into the November election.

What Are You Lookin’ At?

By: Rob Bernstein, RGB Capital Group

Published: 8.3.20

Not all stocks are thriving in the current market environment and much of the market is still wrestling with the consequences of an economy that was shut down as a result of the coronavirus. The future direction of the stock market

will be dependent on events that have yet to happen including the future spread of the virus, the timing of a vaccine(s) that is(are) widely available for distribution and what type of financial assistance may be available to individuals and businesses over the coming weeks/months that continue to struggle to pay their bills.

The NAAIM Dynamic Allocation Model

Designed to be a value-add benefit to membership, NAAIM offers a Dynamic Asset Allocation Model based on the NAAIM Indicator Wall of indicators and models. The overall objective of the model portfolio is to dynamically adapt to changing market environments and to keep equity exposure in line with conditions. The model targets a normalized allocation of 60% stocks and 40% Bonds.

Here is this week’s model allocation:

The model has been run live on the NAAIM website for several years and has demonstrated the ability to reduce exposure to market risk during negative environments such as those seen in 2015-16 and 2018.

More on the Dynamic Allocation Model and Historical Readings

The NAAIM Dynamic Allocation Model is for illustrative and informational purposes only, and does not in any way represent an endorsement by NAAIM or an investment recommendation.

Gold Continues To Sparkle

By: Sam and Bo Bills Bills Asset Management

Published: 7.24.20

Gold continues to sparkle. The yellow metal has taken off over the last few weeks and is nearing its all-time highs. The all time high will be significant resistance and lays a little over 1% from current levels. While we are not adding to our gold position at these levels, we are likely to add to our holdings on any pull-backs. We are bullish on gold for a number of reasons and believe that new highs will be set in the coming weeks/months. W

Odds Of Big Decline Are…

By: Craig Thompson, President Asset Solutions

Published: 8.6.20

I am not seeing anything in market technicals that suggests elevated stock market risk. That could change and does not mean that the market couldn’t pullback to some degree in the coming days/weeks. However, the odds of a major move down or bear market is unlikely.

Leaders Still Leading!

By: Dexter P. Lyons Issachar Fund

Published: 8.3.20

Growth stocks still appear to be under accumulation/buying by big institutions as they pile into a select group of stocks exhibiting increasing sales and earnings. Value stocks, for the most part, appear to be under distribution/selling but that could change if the market perceives the lockdowns will be eased. Software, Medical, Chips, and Telecom “clouds” are the dominant themes…

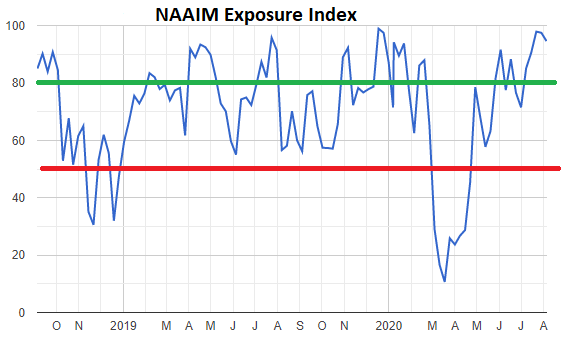

The NAAIM Member Exposure Index: Managers Riding Bull Train

The NAAIM Exposure Index represents the average exposure to US Equity markets as reported by our members in the organization’s weekly survey. Note that many NAAIM members are risk managers and tend to reduce exposure to the markets during high risk environments.

The last week’s exposure reading was 94.6, which means NAAIM Managers are fully invested.

More on the NAAIM Exposure Index

NOT INVESTMENT ADVICE. The analysis and information in this report and on our website is for informational purposes only. No part of the material presented in this report or on our websites is intended as an investment recommendation or investment advice. Neither the information nor any opinion expressed nor any Portfolio constitutes a solicitation to purchase or sell securities or any investment program. The opinions and forecasts expressed are those of the editors and may not actually come to pass. The opinions and viewpoints regarding the future of the markets should not be construed as recommendations of any specific security nor specific investment advice. Investors should always consult an investment professional before making any investment.

Tags: NAAIM, NAAIM Speaks, Stocks market analysis, Stock Market Analysis, Stock market, stock market indicators, David Moenning, Paul Schatz, Jeffrey Miller, Rob Bernstein, Ryan Redfern, Sam Bills, Bo Bills, Dexter Lyons, Craig Thompson, Len Fox, NAAIM Exposure Index, NAAIM Dynamic Allocation Model