NAAIM Speaks is monthly newsletter containing market insights and analysis from NAAIM member firms. This newsletter is designed to provide a plethora of market analysis, indicators, some occasional humor, as well as a summary of NAAIM’s proprietary Dynamic Asset Allocation Model and Managers Exposure Index. The report is for informational uses only and is not to be construed as investment advice.

Santa Getting Tested

By: David Moenning, Heritage Capital Research

Published: 12.06.21

While there is still time for the traditional Santa Claus rally to begin, the current correction in stocks, which so far at least falls into the “garden variety” category, goes against the positive market vibe typically seen at this time of year….

When Everyone Has Conviction, They Are Usually Wrong

By: Paul Schatz, Heritage Capital LLC

Published: 12.06.21

As I did my usual weekend reading it was interesting to see such high conviction opinions on where the markets are headed. It seemed like everyone saw the recent pullback as a tremendous buying opportunity or a stern warning of things to come. Very few folks sat on the fence. I love that people have high conviction. I usually do as well…

Playing It Safe, For Now

By: Ryan C. Redfern ShadowRidge Asset Management

Published: 11.26.21

Last month we were looking at how the odds favored a positive November in the S&P 500, and so far, it looks like that is what we’re going to get. While the strong upward momentum coming out of the late September market lows has slowed, it is our hope that the S&P 500 and other major markets hold these price levels from here. But there look to be various obstacles going into the end of the year…

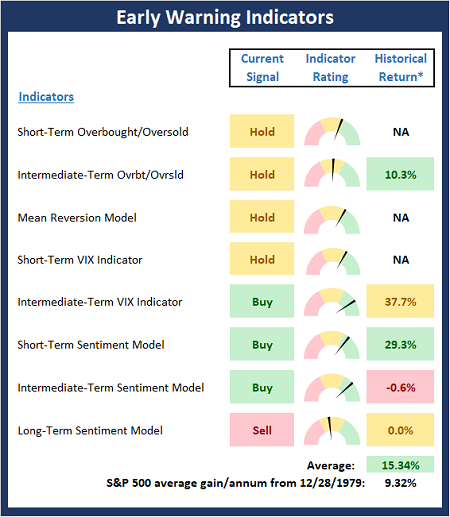

The Message From the NAAIM Indicator Wall

By: National Association of Active Investment Managers

Updated: 12.06.21

The NAAIM Indicator Wall provides a weekly update to a robust array of stock market indicators. The “wall” includes readings and explanations of indicators and/or models in the areas of price/trend, momentum, key price levels, overbought/sold readings, sentiment, monetary, economic, inflation, and market cycles.

This time, we’re featuring the Early Indicator Board , which is designed to suggest when the table is set for the trend to “go the other way.” Note this board did a nice job warning of both the most recent correction and the ensuing bounce.

Note: The Indicator Wall is a benefit provided to NAAIM Members and is password protected. To obtain a temporary password, contact NAAIM at 888-261-0787.

The Real Story Behind The Move Isn’t Omicron

By: Rob Bernstein, RGB Capital Group

Published: 12.06.21

The stock market is subject to many forces, most of which we are unable to ascertain in real time. While the new Omicron

variant of the COVD-19 virus has been subject to numerous news headlines, I believe the real story is the Federal Reserve…

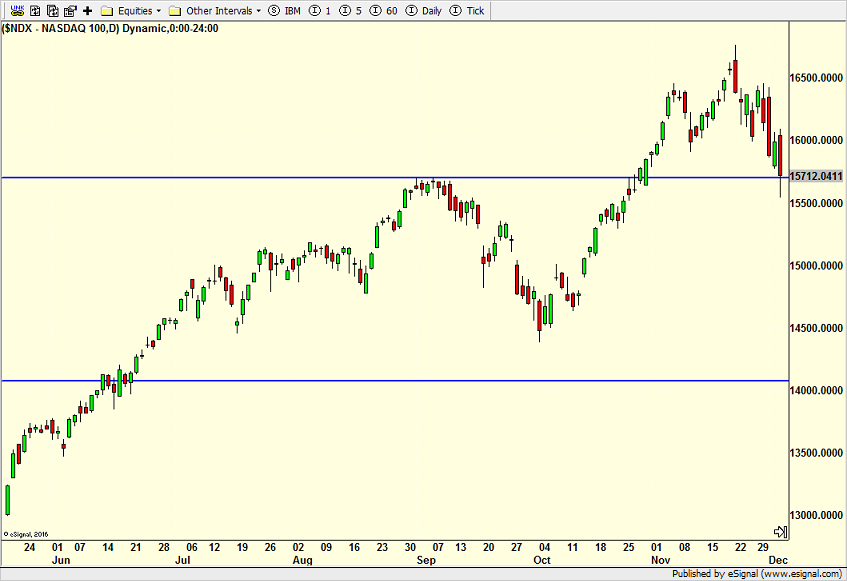

Stocks At Critical Juncture

By: Craig Thompson, President Asset Solutions

Published: 12.06.21

Stocks have declined and market breadth has continued to deteriorate over the past month. The S&P 500 is at a critical level sitting right at support being provided by the September highs and a rising 50-day moving average line. $4,500 is a very important level. If price breaks decisively below this level it would have bearish implications for the broader stock market…

The NAAIM Dynamic Allocation Model

Designed to be a value-add benefit to membership, NAAIM offers a Dynamic Asset Allocation Model based on the NAAIM Indicator Wall of indicators and models. The overall objective of the model portfolio is to dynamically adapt to changing market environments and to keep equity exposure in line with conditions. The model targets a normalized allocation of 60% stocks and 40% Bonds.

Here is this week’s model allocation:

The model has been run live on the NAAIM website for several years and has demonstrated the ability to reduce exposure to market risk during negative environments such as those seen in 2015-16 and 2018.

More on the Dynamic Allocation Model and Historical Readings

The NAAIM Dynamic Allocation Model is for illustrative and informational purposes only, and does not in any way represent an endorsement by NAAIM or an investment recommendation.

Oh My-Cron

By: Sam and Bo Bills Bills Asset Management

Published: 12.03.21

What was supposed to be a quiet Thanksgiving weekend turned into a quick downdraft in the markets. The new Covid variant

Omicron got the bad rap for spoiling an otherwise wonderful Thanksgiving. While Omicron was the catalyst the markets were due

for a correction. With the Fed signaling tightening by way of the taper and the Fed’s realization (where have they been?) that

inflation is more than transitory and higher rates may be a necessity, a catalyst was all that was needed to provide a much-needed

pullback…

Not Taking Any Chances

By: Dexter P. Lyons Issachar Fund

Published: 12.06.21

The Issachar Fund went to 100% Cash on Black Friday, one day after Thanksgiving, as risk raised its ugly head! The market controls/provides the return we receive, so when I am not rewarded for taking risk, I prefer to sit on the sidelines and wait for conditions to change…

The NAAIM Member Exposure Index

The NAAIM Exposure Index represents the average exposure to US Equity markets as reported by our members in the organization’s weekly survey. Note that many NAAIM members are risk managers and tend to reduce exposure to the markets during high risk environments.

NOT INVESTMENT ADVICE. The analysis and information in this report and on our website is for informational purposes only. No part of the material presented in this report or on our websites is intended as an investment recommendation or investment advice. Neither the information nor any opinion expressed nor any Portfolio constitutes a solicitation to purchase or sell securities or any investment program. The opinions and forecasts expressed are those of the editors and may not actually come to pass. The opinions and viewpoints regarding the future of the markets should not be construed as recommendations of any specific security nor specific investment advice. Investors should always consult an investment professional before making any investment.

Tags: NAAIM, NAAIM Speaks, Stocks market analysis, Stock Market Analysis, Stock market, stock market indicators, David Moenning, Paul Schatz, Rob Bernstein, Ryan Redfern, Sam Bills, Bo Bills, Dexter Lyons, Craig Thompson, NAAIM Exposure Index, NAAIM Dynamic Allocation Model