NAAIM Speaks is monthly newsletter containing market insights and analysis from NAAIM member firms. This newsletter is designed to provide a plethora of market analysis, indicators, some occasional humor, as well as a summary of NAAIM’s proprietary Dynamic Asset Allocation Model and Managers Exposure Index. The report is for informational uses only and is not to be construed as investment advice.

GDP Getting Real

By: David Moenning, Heritage Capital Research

Published: 08.01.22

There is an awful lot of talk about recession these days. The bears point to a second negative GDP print as reason to believe we are already in recession. But, but, but… It is critically important to recognize that the headline GDP print is “Real GDP,” which, by definition, includes adjustments for… wait for it… inflation. In the GDP report there are actually two rates of growth provided, “real” and “nominal.” Meaning, in simple terms, with and without inflation. And the difference between these two numbers really tells the story here.

Dog Days of August

By: Paul Schatz, Heritage Capital LLC

Published: 08.03.22

I can’t believe it’s already August. I am not ready for the countdown to end summer, even though ski season may only be 100 or so days away. I like wearing shorts, tee shirts and flip flops. Where has the year gone? Can we slow down a bit? July’s market action was a whole lot more fun for the bulls…

Recession? It Doesn’t Matter

By: Ryan C. Redfern ShadowRidge Asset Management

Published: 07.29.22

A big news item is that we got the numbers to confirm the second quarter of negative GDP. Since I can remember this has been used as the gauge to declare a recession, though I understand that the current stance is that “recession” is not yet “official.” There has been quite a bit of effort to dismiss this GDP data point due to the continued low unemployment. And at the end of the day, it doesn’t matter if we are or we aren’t in a recession, but how we react.

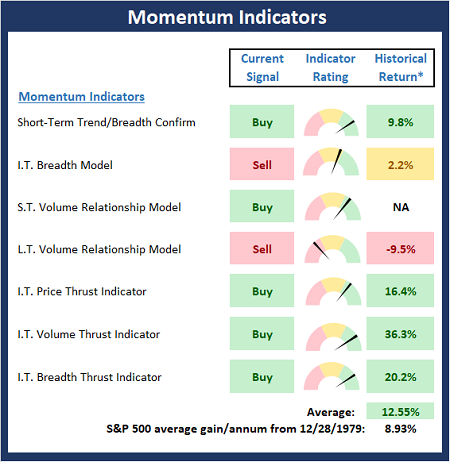

The Message From the NAAIM Indicator Wall

By: National Association of Active Investment Managers

Updated: 07.01.2022

The NAAIM Indicator Wall provides a weekly update to a robust array of stock market indicators. The “wall” includes readings and explanations of indicators and/or models in the areas of price/trend, momentum, key price levels, overbought/sold readings, sentiment, monetary, economic, inflation, and market cycles.

This time, we’re featuring the Momentum Board , which is designed to show if there is any “oomph” behind the current move.

Note: The Indicator Wall is a benefit provided to NAAIM Members and is password protected. To obtain a temporary password, contact NAAIM at 888-261-0787.

Questions Remain

By: Rob Bernstein, RGB Capital Group

Published: 08.01.22

Short-term market conditions have improved dramatically but questions remain about the longer-term trend of the market. Whether the recent rally is the beginning of a new bull market or simply a countertrend rally within an ongoing bear market will not be known until some point in the future. But for now…

Coiled Spring

By: Craig Thompson, President Asset Solutions

Published: 07.04.22

The market is in a short-term advance within a longer-term decline. The question is. Has the market bottomed and is this the beginning of a longer-term move higher or is the advance a bear trap? The market is at an inflection point and a few of the indicators I will…

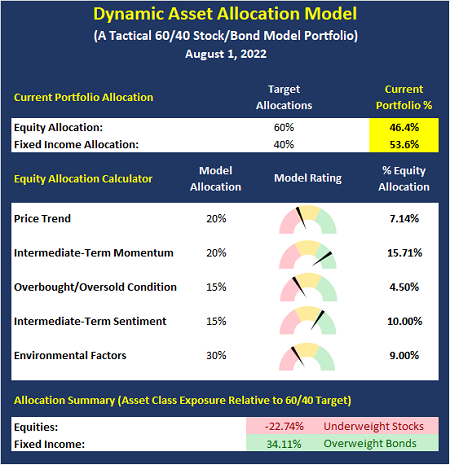

The NAAIM Dynamic Allocation Model

Designed to be a value-add benefit to membership, NAAIM offers a Dynamic Asset Allocation Model based on the NAAIM Indicator Wall of indicators and models. The overall objective of the model portfolio is to dynamically adapt to changing market environments and to keep equity exposure in line with conditions. The model targets a normalized allocation of 60% stocks and 40% Bonds.

Here is this week’s model allocation:

The model has been run live on the NAAIM website for several years and has demonstrated the ability to reduce exposure to market risk during negative environments such as those seen in 2015-16 and 2018.

More on the Dynamic Allocation Model and Historical Readings

The NAAIM Dynamic Allocation Model is for illustrative and informational purposes only, and does not in any way represent an endorsement by NAAIM or an investment recommendation.

The News Is Bad, But…

By: Sam and Bo Bills Bills Asset Management

Published: 07.29.22

By most accounts, the news has all been bad and yet the market continues to rally. It has been a case of the news being less bad than the Armageddon many had predicted/expected. For example, as widely anticipated, the Fed raised rates another 75 basis points. The announcement was largely a non-event and the market liked that.

Looking For Confirmation

By: Dexter P. Lyons Issachar Fund

Published: 08.01.22

If a new bull market has started, the market needs to decisively break above its longer-term downtrend line of resistance on greater volume. Increased government spending will likely increase inflation, and higher taxes and regulations will likely cause slower growth in a recession. I do not like what congress is doing, but the market knows best, so I follow price and volume charts for direction clues.

The NAAIM Member Exposure Index

The NAAIM Exposure Index represents the average exposure to US Equity markets as reported by our members in the organization’s weekly survey. Note that many NAAIM members are risk managers and tend to reduce exposure to the markets during high risk environments.

NOT INVESTMENT ADVICE. The analysis and information in this report and on our website is for informational purposes only. No part of the material presented in this report or on our websites is intended as an investment recommendation or investment advice. Neither the information nor any opinion expressed nor any Portfolio constitutes a solicitation to purchase or sell securities or any investment program. The opinions and forecasts expressed are those of the editors and may not actually come to pass. The opinions and viewpoints regarding the future of the markets should not be construed as recommendations of any specific security nor specific investment advice. Investors should always consult an investment professional before making any investment.

Tags: NAAIM, NAAIM Speaks, Stocks market analysis, Stock Market Analysis, Stock market, stock market indicators, David Moenning, Paul Schatz, Rob Bernstein, Ryan Redfern, James Lee, Sam Bills, Bo Bills, Dexter Lyons, Craig Thompson, NAAIM Exposure Index, NAAIM Dynamic Allocation Model