NAAIM Speaks is monthly newsletter containing market insights and analysis from NAAIM member firms. “Speaks” is designed to provide a plethora of market analysis, indicators, some occasional humor, as well as a summary of NAAIM’s proprietary Dynamic Asset Allocation Model and Managers Exposure Index. The report is for informational uses only and is not to be construed as investment advice.

Don’t Look Now, But Valuations Are Improving

By: David Moenning, Heritage Capital Research

Published: 8.9.21

One of the bear camp’s major arguments is that stock market valuations are scary-high right now. And since we are likely seeing “peak everything” here, our furry friends suggest that there is only one way for stock prices to go from here – down. But…

Warning Signs Abound

By: Paul Schatz, Heritage Capital LLC

Published: 8.9.21

The warning signs are abound. Yet, price just keeps on chugging higher. Remember, in the end price is always the final arbiter. I can warn and warn and warn as prices either go sideways or higher and higher. Eventually, it will matter, but…

The Message From the NAAIM Indicator Wall

By: National Association of Active Investment Managers

Updated: 8.9.21

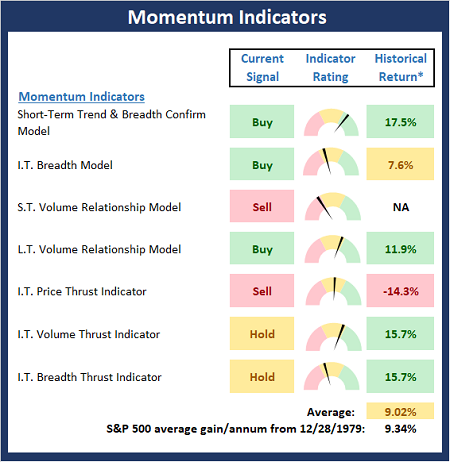

The NAAIM Indicator Wall provides a weekly update to a robust array of stock market indicators. The “wall” includes readings and explanations of indicators and/or models in the areas of price/trend, momentum, key price levels, overbought/sold readings, sentiment, monetary, economic, inflation, and market cycles.

This time, we’re featuring the Momentum Indicator Board , which is designed to determine if there is any “oomph” behind the current move.

Note: The Indicator Wall is a benefit provided to NAAIM Members and is password protected. To obtain a temporary password, contact NAAIM at 888-261-0787.

Mixed Signals

By: Rob Bernstein, RGB Capital Group

Published: 8.9.21

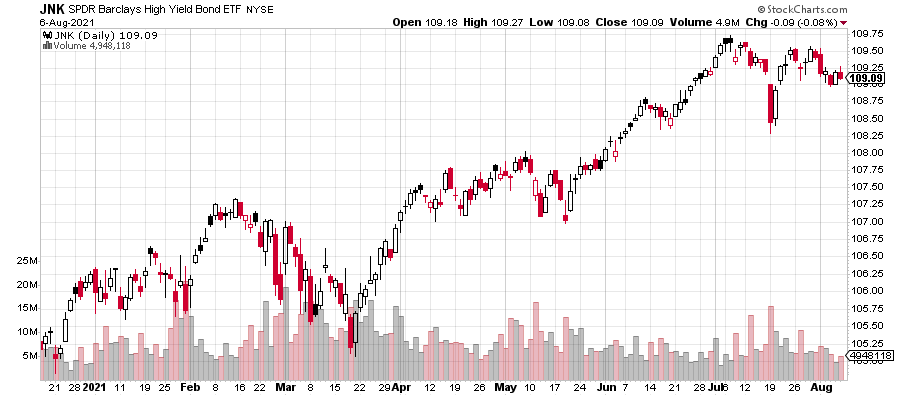

The stock market continues to be pulled by conflicting forces. Strong corporate earnings, an increase in the number of jobs

created and hopes an infrastructure bill will be passed as early as this week are offset by supply chain constraints, higher

inflation expectations and the spread of the COVID Delta variant including the additional restrictions that are put in place to

stop the spread…

Charts Suggesting No Inflation Problem

By: Craig Thompson, President Asset Solutions

Published: 8.2.21

While we are likely at the beginning of a long-term (Secular) period of inflation, in the near term we seem to be experiencing deflation as seen in financial markets. I know that this may come as a surprise given that the price of consumer goods is rising and all the media content seems to be highlighting an environment of run-away inflation….

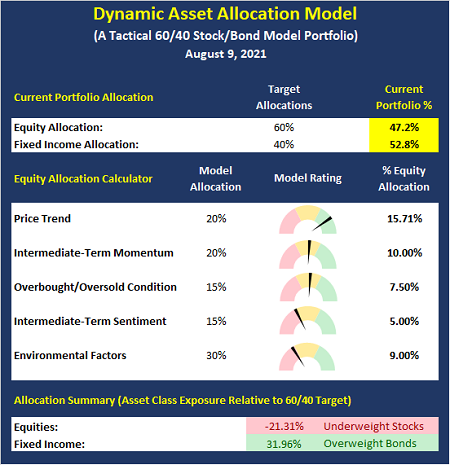

The NAAIM Dynamic Allocation Model

Designed to be a value-add benefit to membership, NAAIM offers a Dynamic Asset Allocation Model based on the NAAIM Indicator Wall of indicators and models. The overall objective of the model portfolio is to dynamically adapt to changing market environments and to keep equity exposure in line with conditions. The model targets a normalized allocation of 60% stocks and 40% Bonds.

Here is this week’s model allocation:

The model has been run live on the NAAIM website for several years and has demonstrated the ability to reduce exposure to market risk during negative environments such as those seen in 2015-16 and 2018.

More on the Dynamic Allocation Model and Historical Readings

The NAAIM Dynamic Allocation Model is for illustrative and informational purposes only, and does not in any way represent an endorsement by NAAIM or an investment recommendation.

Caution Remains Warranted

By: Sam and Bo Bills Bills Asset Management

Published: 8.6.21

The S&P continues to confound all those that are even the slightest bit bearish. With new highs again this week, the index continues to get stretched higher to the upside. A mean reversion is coming, but when is anybody’s guess. The stage is set for a pullback…

Fed Keeps Printing

By: Dexter P. Lyons Issachar Fund

Published: 8.9.21

The employment numbers came in better-than-expected Friday, and yields spiked, indicating the Fed may have to raise rates sooner than expected to tame inflation. Mr. market seems to be hooked on low rates, so any hint of higher rates has spooked the market into profit-taking mode. I am not too concerned because I believe Jay Powell will do what it takes to keep rates low and liquidity flowing to increase his chances of getting reappointed as Federal Reserve Chairman next year. …

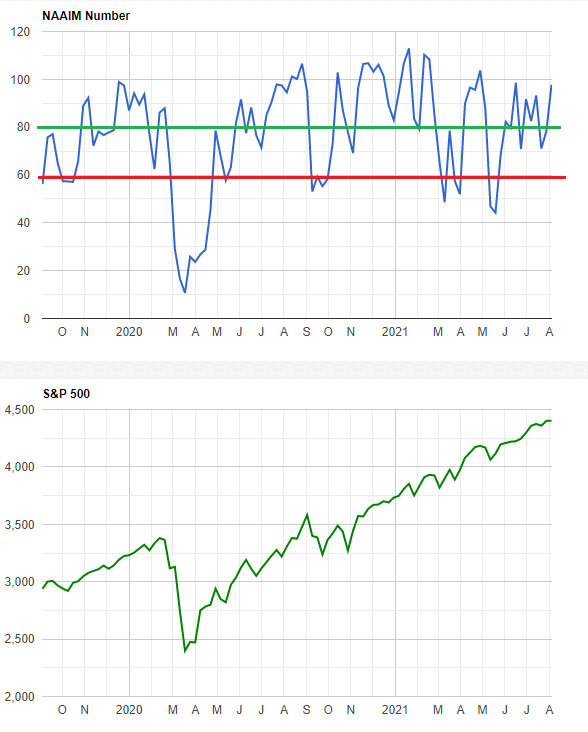

The NAAIM Member Exposure Index

The NAAIM Exposure Index represents the average exposure to US Equity markets as reported by our members in the organization’s weekly survey. Note that many NAAIM members are risk managers and tend to reduce exposure to the markets during high risk environments.

NOT INVESTMENT ADVICE. The analysis and information in this report and on our website is for informational purposes only. No part of the material presented in this report or on our websites is intended as an investment recommendation or investment advice. Neither the information nor any opinion expressed nor any Portfolio constitutes a solicitation to purchase or sell securities or any investment program. The opinions and forecasts expressed are those of the editors and may not actually come to pass. The opinions and viewpoints regarding the future of the markets should not be construed as recommendations of any specific security nor specific investment advice. Investors should always consult an investment professional before making any investment.

Tags: NAAIM, NAAIM Speaks, Stocks market analysis, Stock Market Analysis, Stock market, stock market indicators, David Moenning, Paul Schatz, Rob Bernstein, Ryan Redfern, Sam Bills, Bo Bills, Dexter Lyons, Craig Thompson, NAAIM Exposure Index, NAAIM Dynamic Allocation Model