NAAIM Speaks is monthly newsletter containing market insights and analysis from NAAIM member firms. This newsletter is designed to provide a plethora of market analysis, indicators, some occasional humor, as well as a summary of NAAIM’s proprietary Dynamic Asset Allocation Model and Managers Exposure Index. The report is for informational uses only and is not to be construed as investment advice.

Don’t Fight The Fed?

By: David Moenning, Heritage Capital Research

Published: 04.11.22

The late, great Marty Zweig, who had a huge influence on my career at a young age, was famous for his approach to managing risk in the stock market. As longtime readers are likely aware, one of his primary rules was, “Don’t fight the Fed.” Zweig, who along with Ned Davis (another constant influence on my approach to managing money) found creative ways to model such things via computers, which was a pretty novel approach back in the 1980’s and early 1990’s. Oh, and for the record, the Zweig Bond model is currently on a sell signal. So…

Oil Bear Rages On

By: Paul Schatz, Heritage Capital LLC

Published: 04.11.22

Stocks return from the weekend the same way they began the weekend, on the defensive. After closing above the highest levels seen in February and sucking in investors, the stock market promptly reversed and is now pulling back again. The Dow Industrials and the S&P 500 are mild so far, but the S&P 400, Russell 2000 and NASDAQ 100 are deeper and more concerning…

Our Biggest Concern

By: Ryan C. Redfern ShadowRidge Asset Management

Published: 03.25.22

Our biggest concern right now is the Federal Reserve raising rates too aggressively. On March 16th, they started this process, and already we are seeing higher rates on variable interest instruments like credit cards and personal loans. This particularly hurts those who carry a high debt burden. Although it could be a positive for savers, who hopefully will see an increase in savings and money market rates (which have been dismal). But the thing is, the Fed needs to raise rates…

The Message From the NAAIM Indicator Wall

By: National Association of Active Investment Managers

Updated: 03.07.22

The NAAIM Indicator Wall provides a weekly update to a robust array of stock market indicators. The “wall” includes readings and explanations of indicators and/or models in the areas of price/trend, momentum, key price levels, overbought/sold readings, sentiment, monetary, economic, inflation, and market cycles.

This time, we’re featuring the Fundamentals Board , which is designed to review the market’s fundamental factors including interest rates, the economy, earnings, inflation, and valuations.

Note: The Indicator Wall is a benefit provided to NAAIM Members and is password protected. To obtain a temporary password, contact NAAIM at 888-261-0787.

It’s a Downtrend

By: Rob Bernstein, RGB Capital Group

Published: 04.11.20

The stock market is in an intermediate-term downtrend as can be seen on the charts above. There are a variety of factors

influencing the financial markets including higher inflation, a tight labor market, the ripple effect of the Russia/Ukraine war

and a more hawkish Federal Reserve. If these factors lead to slower corporate growth, well…

Risk-On or Risk-Off??

By: Craig Thompson, President Asset Solutions

Published: 04.11.22

In today’s update, I analyze the stock market by determining if we are in a bullish, risk-on environment or a bearish, risk-off environment…

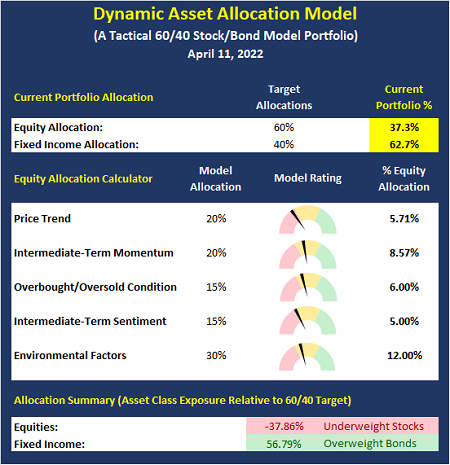

The NAAIM Dynamic Allocation Model

Designed to be a value-add benefit to membership, NAAIM offers a Dynamic Asset Allocation Model based on the NAAIM Indicator Wall of indicators and models. The overall objective of the model portfolio is to dynamically adapt to changing market environments and to keep equity exposure in line with conditions. The model targets a normalized allocation of 60% stocks and 40% Bonds.

Here is this week’s model allocation:

The model has been run live on the NAAIM website for several years and has demonstrated the ability to reduce exposure to market risk during negative environments such as those seen in 2015-16 and 2018.

More on the Dynamic Allocation Model and Historical Readings

The NAAIM Dynamic Allocation Model is for illustrative and informational purposes only, and does not in any way represent an endorsement by NAAIM or an investment recommendation.

Changing SOXX

By: Sam and Bo Bills Bills Asset Management

Published: 04.08.22

Like high yield bonds, semiconductors often have predictive power over the economy. With semiconductors being used in an ever-increasing number of consumer goods, the outlook (see chart) can foretell of issues to the economy…

Time For Alternative Ideas

By: Dexter P. Lyons Issachar Fund

Published: 04.11.22

The market is trying to position itself ahead of higher inflation, slower growth, and a less accommodative Fed, so they came after the chips, transportation, and higher P/E growth stocks last week. The junk bond market rolled over in January, indicating that the market may have lost its risk appetite and has been struggling since. When the market is not rewarding risk-takers, I look at alternative investments …

The NAAIM Member Exposure Index

The NAAIM Exposure Index represents the average exposure to US Equity markets as reported by our members in the organization’s weekly survey. Note that many NAAIM members are risk managers and tend to reduce exposure to the markets during high risk environments.

NOT INVESTMENT ADVICE. The analysis and information in this report and on our website is for informational purposes only. No part of the material presented in this report or on our websites is intended as an investment recommendation or investment advice. Neither the information nor any opinion expressed nor any Portfolio constitutes a solicitation to purchase or sell securities or any investment program. The opinions and forecasts expressed are those of the editors and may not actually come to pass. The opinions and viewpoints regarding the future of the markets should not be construed as recommendations of any specific security nor specific investment advice. Investors should always consult an investment professional before making any investment.

Tags: NAAIM, NAAIM Speaks, Stocks market analysis, Stock Market Analysis, Stock market, stock market indicators, David Moenning, Paul Schatz, Rob Bernstein, Ryan Redfern, Sam Bills, Bo Bills, Dexter Lyons, Craig Thompson, NAAIM Exposure Index, NAAIM Dynamic Allocation Model