I was in Denver this week presenting at a large investor forum. I shared with the audience two valuation charts I believe you will find interesting. One looks at forward PE (a measure I disfavor). The other is what Warren Buffett called “probably the best single measure of where valuations stand at any given moment” in a 2001 Fortune Magazine interview.

Often I hear the argument that the market is inexpensively priced at a current PE of just 15. Several readers responded to my recent Forbes piece challenging my view that the market is overvalued. They all pointed to the lower forward PE which is based on Wall Street analyst’s forward estimated earnings. The reason I disfavor forward PE is that Wall Street analysts have a bad habit of consistently missing the mark. The Forbes piece was titled, Stock Market’s High P/E Suggests Lower Returns Ahead.

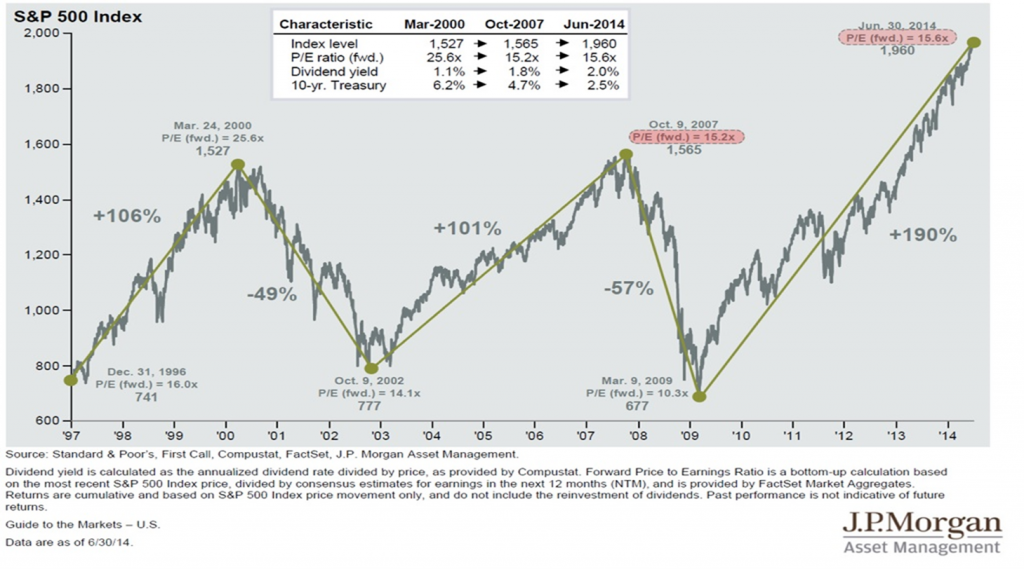

I wish I had included the following chart in that article. It shows what happened the last time forward PE was north of 15 (as it is today). It was 15.2x at the market peak in October 2007 – a -57% decline followed. It is 15.6 today.

The simple point is that when you buy in when the market is expensively priced, forward potential return is lower and risk considerably higher. The first bullet in today’s On My Radar shows Buffet’s favorite valuation measure – Stock Market Capitalization as a Percentage of Nominal GDP. It shows a market that is more overvalued today than it was in 2007 or any other period in time dating back to 1925 (with just one exception, March 2000).

Steve Blumenthal

Founder & CEO CMG

Stephen Blumenthal founded CMG in 1992. He is CEO, Chief Investment Officer and portfolio manager at Capital Management Group, Inc. where he manages equity and tactical investment portfolios. He is a frequent speaker and writer on investment strategies and has been featured in various media sources including the Wall Street Journal, Barron’s, Investor’s Business Daily, Pensions & Investments Magazine, Investment News, RIA Biz and Smart Money. He has been a guest on CNBC, Wall Street Journal Live, and Bloomberg. Mr. Blumenthal is a frequent speaker at industry conferences (NAPFA, IMCA, Index Universe, Opal Financial Group Indexing & ETF Summit and NAAIM) and is author of CMG’s popular investment research commentary. With 30 years of investment management and industry experience, prior to founding CMG, Mr. Blumenthal worked for Merrill Lynch Institutional, Merrill Lynch Retail and Prudential Securities.

Mr. Blumenthal graduated with a Bachelor of Science degree in Accounting from Pennsylvania State University. He is married, has three children and is active in his community coaching youth soccer.